Welcome to this insightful exploration of natural disasters and their impact on the insurance industry. This article delves into the challenges faced by insurers in ensuring continuity of service amidst the rising frequency and severity of natural disasters. Join us as we navigate through the complexities of claims management, the role of technology, and the importance of empathy and clear communication in helping communities rebuild.

Navigating the Challenges of Claims Management in the Face of Increasing Natural Disasters

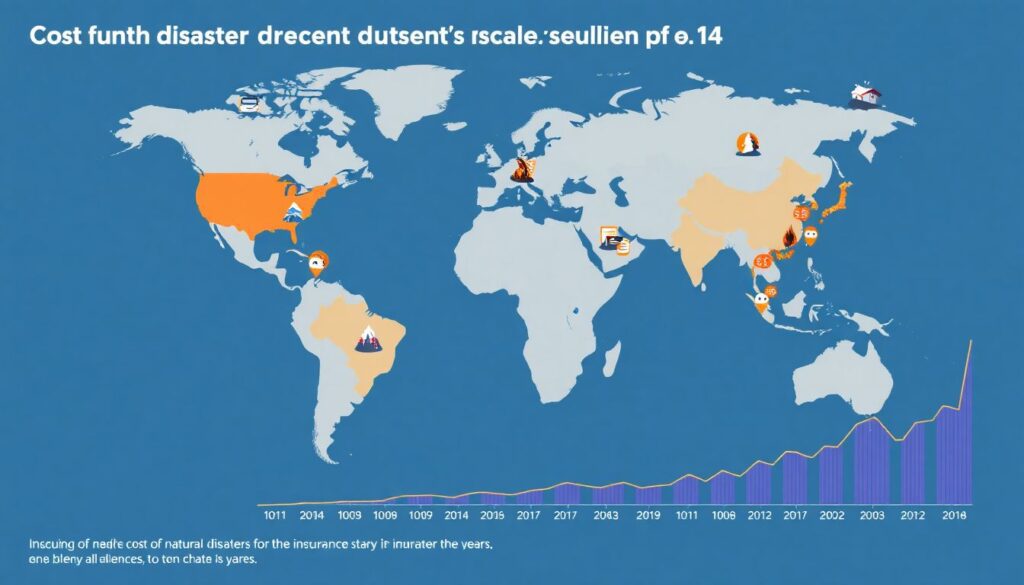

Imagine a vivid global map, splashed with a spectrum of colors and icons that tell a story of resilience and upheaval. This isn’t your ordinary atlas, but a living document of the Earth’s most challenging moments. From the lush greens of the Amazon rainforest, marked with raging wildfire icons, to the coastal blues of the United States, peppered with hurricane swirls, and the rivers of Southeast Asia, highlighted with flood icons – this map is a stark reminder of nature’s raw power.

As you zoom in, the map reveals intricate details about recent natural disasters. Each icon represents a story of communities tested, homes lost, and lives changed. Flood icons submerge parts of Europe, while wildfire icons blaze across Australia, and hurricane icons spiral over the Philippines. The map is not just a geographical representation, but a testament to the global scale of natural disasters.

Beside this map, a graph paints an equally compelling picture – the rising cost of natural disasters to the insurance industry. The line on the graph climbs steadily, marking the increasing financial burden over the years. Each spike represents a major event, a storm, a fire, a flood, translating human loss into stark economic terms. The graph is more than just data; it’s a call to action, a reminder of the urgent need for mitigation, adaptation, and innovative solutions in the face of these global challenges.

The Rising Tide of Natural Disasters

In recent years, the world has witnessed an alarming increase in the frequency and severity of natural disasters, with floods and wildfires emerging as some of the most devastating events. Communities across the globe are grappling with these catastrophic occurrences, which have led to significant loss of life, property damage, and economic disruption. According to the World Meteorological Organization, the number of weather-related disasters has increased by a factor of five over the past 50 years, with floods and wildfires being prominent contributors to this stark trend.

Climate change, driven primarily by human activities, is exacerbating these natural disasters, creating a vicious cycle of environmental degradation and escalating risks. Warmer temperatures are causing more intense and frequent heatwaves, which in turn fuel larger and more destructive wildfires. Consider the following points on how climate change influences these events:

- Prolonged Droughts: Higher temperatures lead to increased evaporation, creating drier conditions that exacerbate droughts and prime landscapes for wildfires.

- Erratic Precipitation: Climate change is altering precipitation patterns, leading to heavier rainfall events that overwhelm infrastructure and result in severe flooding.

- Shifting Weather Patterns: Changes in atmospheric circulation can cause prolonged periods of dry weather, followed by intense downpours, exacerbating both wildfire and flood risks.

The impact of these events is not just immediate but has long-lasting repercussions. Floods can contaminate water supplies, destroy crops, and displace communities, while wildfires can decimate ecosystems, release vast amounts of carbon dioxide, and leave behind scorched landscapes prone to erosion and further flooding. The economic toll is equally devastating, with billions of dollars spent on recovery efforts each year.

Looking ahead, recent reports paint a grim picture if current trends continue. The Intergovernmental Panel on Climate Change (IPCC) predicts that without significant reductions in greenhouse gas emissions, the frequency and severity of extreme weather events will continue to rise. By the end of the century, global temperatures could increase by more than 4°C, leading to:

- More frequent and intense heatwaves, exacerbating wildfire risks.

- Increased precipitation variability, with more severe flooding events.

- Rising sea levels, amplifying the impact of coastal flooding and storm surges.

The urgency to address climate change and build resilience against these natural disasters has never been greater. Communities, governments, and organizations must work together to implement sustainable practices, reduce emissions, and prepare for the challenges ahead.

The Insurance Industry’s Role

In the face of natural disasters, businesses and the insurance industry play a crucial, dual role in mitigating impact and facilitating recovery. Businesses, as the economic engines of our communities, bear the responsibility of implementing robust emergency management plans to protect assets and ensure continuity. This includes investing in resilient infrastructure, training employees, and developing contingency plans. The insurance industry, on the other hand, serves as a financial safety net, absorbing the economic shock waves generated by natural disasters.

Sufficient coverage is a lifeline for organizations reeling from a natural disaster. It can mean the difference between rapid recovery and closure. Business interruption insurance, for instance, can compensate for lost income, while property insurance can fund repairs and replacements. However, many businesses find themselves underinsured when disaster strikes, due to inadequate policy limits, overlooked endorsements, or excluded perils. Regular policy reviews and open communication with insurers can help ensure adequate protection.

When disaster strikes, claims teams swing into action, managing property and business interruption claims to help businesses back on their feet. However, they face a myriad of challenges. These include:

- Scale of damage: Natural disasters often affect multiple insureds simultaneously, leading to a surge in claims.

- Accessibility issues: Infrastructure damage can hinder access to affected sites, delaying inspections.

- Complexity of losses: Business interruption claims, in particular, can be complex to quantify, involving detailed financial analysis.

- Emotional toll: Claims adjusters often deal with policyholders in distress, requiring a high degree of empathy and professionalism.

To overcome these challenges, claims teams must embrace technology, such as aerial imagery and remote claims handling, and invest in training and self-care. Moreover, insurers can streamline processes, such as pre-loss agreements and expedited claims procedures, to facilitate swift recovery. By working together, businesses and the insurance industry can build resilience, promote swift recovery, and fortify communities against the impact of natural disasters.

Overcoming Key Hurdles

The insurance industry faces a triad of challenges when it comes to assessing and resolving natural catastrophe claims. First and foremost is the need for reliable on-the-ground intelligence. When disasters strike, infrastructure is often compromised, making it difficult to get an accurate picture of the damage. Having ‘eyes and ears on the ground’ enables insurers to gather real-time data, assess the extent of losses, and provide immediate assistance to policyholders. However, this task is often fraught with obstacles such as:

- Limited access to affected areas due to debris, flooding, or other hazards

- Strained local resources, including communication networks

- The need to ensure the safety of claims adjusters and other personnel

The second key hurdle is access to accurate information. In the aftermath of a natural catastrophe, reliable data can be scarce. Yet, insurers need precise information to evaluate claims effectively and prevent fraudulent activities. Several factors contribute to this challenge:

- The chaotic nature of disaster zones, where information may be conflicting or incomplete

- The time-consuming process of verifying claims data against policy records

- The potential for miscommunication or exaggeration of damages by distressed policyholders

Lastly, there is the pressing need to speed up the settlement process. Delays in claim resolution can exacerbate the financial burden on policyholders, who are often already grappling with the emotional and physical toll of a natural disaster. Streamlining the settlement process ensures that funds are disbursed quickly, enabling families and businesses to start rebuilding. Nevertheless, accelerating settlements is a complex task, hindered by:

- The sheer volume of claims following a major catastrophe

- The need to balance speed with accuracy in assessing damages

- Regulatory requirements that may add layers of complexity to the claims process

Overcoming these hurdles requires a multi-pronged approach that leverages technology, strengthens collaboration with local authorities, and enhances communication with policyholders. By investing in innovative solutions and robust planning, the insurance industry can significantly improve its response to natural catastrophes, ensuring that help arrives swiftly and effectively when it’s needed most.

The Future of Claims Management

As we gaze into the future of claims management, we find ourselves faced with a world where natural disasters are increasingly frequent and severe. From wildfires that ravage entire communities to hurricanes that inundate cities, the need for efficient and compassionate claims management has never been more critical. As these events become more commonplace, the industry must evolve to meet the challenges head-on, ensuring that communities can rebuild swiftly and resiliently.

Technology stands at the forefront of this evolution. With advancements such as artificial intelligence (AI) and machine learning (ML), claims processing can be expedited significantly. AI can automate routine tasks, freeing up adjusters to focus on complex cases that require a human touch. Meanwhile, ML algorithms can predict and detect fraudulent claims, ensuring that resources are allocated fairly and efficiently. Moreover, the use of drones and satellite imagery can provide real-time data on affected areas, allowing for faster assessments and quicker settlements.

- AI and ML for automated claims processing

- Drones and satellite imagery for real-time data

These technological innovations not only streamline the claims process but also ensure that help reaches those in need as quickly as possible.

However, technology alone is not enough. In the aftermath of a natural disaster, empathy becomes a crucial component of claims management. Insurance providers must prioritize the human element, understanding that behind every claim is a person or family in need. Training staff to approach each case with compassion and understanding can make a world of difference. This includes being proactive in reaching out to policyholders, offering clear explanations of the claims process, and providing regular updates on the status of their claims. By showing genuine care and concern, insurers can help alleviate some of the stress and anxiety that victims experience.

Clear communication is the final piece of this puzzle. In times of crisis, accurate and timely information is invaluable. Insurance companies must invest in robust communication strategies that keep policyholders informed at every step. This includes using multiple channels such as email, text messages, and phone calls to ensure that everyone stays in the loop. Transparency about what is covered, what is not, and why, can build trust and prevent misunderstandings. Furthermore, providing resources and guides on how to navigate the claims process can empower individuals to take an active role in their recovery. By fostering open and honest communication, insurers can help communities rebuild not just their infrastructure, but also their sense of security and normalcy.

FAQ

How does climate change influence natural disasters?

What are the main challenges faced by insurers in managing natural catastrophe claims?

- Overwhelming volume of claims due to the increasing frequency of natural disasters

- Lack of licensed adjusters in affected areas

- Inadequate knowledge of the insured business

- Empathy and support for risk managers who may have suffered personal loss

How can technology aid in the claims process?

What is the role of accurate information in claims management?

How can insurers speed up the settlement process?

- Having quick access to details and photos of damage

- Estimating likely timeframes for repairs

- Ensuring the correct team is in place to handle the claims

- Maintaining clear communication to mitigate confusion and expedite payments.