Dive into the potential impacts of the Project 2025 proposals on natural disaster relief, particularly focusing on the Small Business Administration’s direct lending program. This article explores how rural communities, which are disproportionately affected by natural disasters, could be left vulnerable if these recommendations are implemented.

Exploring the Potential Impact on Rural Communities

Imagine a once-thriving rural community, now laid bare by nature’s unforgiving hand. The lush fields are now stark and muddy, the homes that once stood proud are reduced to mere remnants, and the familiar hum of daily life is silenced, replaced by an eerie stillness. The local economy, heavily reliant on agriculture and small businesses, has been brought to its knees. Farmers, the backbone of this community, have seen their crops destroyed, livestock lost, and their very livelihoods swept away in the blink of an eye.

The financial struggles are etched deeply into the faces of the locals. The cornerstone businesses—the mom-and-pop stores, the family-owned diners—are now shuttered, their owners grappling with the reality of lost income and mounting debts. The community’s savings are being stretched thin, as people dip into their reserves to repair homes, replace essentials, and simply survive. The future seems uncertain, and hope is in short supply.

In the midst of this devastation, the importance of relief programs cannot be overstated. These lifelines, thrown out by governments, NGOs, and charitable organizations, bring a glimmer of hope to the beleaguered community. Financial aid helps put food on tables, roofs over heads, and seeds back into the ground. Just as crucial are the helping hands that accompany these programs, offering emotional support and a reminder that this community, though battered, is not alone. The road to recovery is long, but with sustained relief efforts, the heartbeat of this rural community can grow strong once more.

The Project 2025 Proposals

In the realm of political and economic policy, Project 2025 has emerged as a influential voice, offering a suite of recommendations that could significantly reshape the business landscape. Among the most notable proposals is the suggested termination of the Small Business Administration’s (SBA) direct lending program.

The recommendation to end the SBA’s direct lending program is a contentious one. The SBA’s program, which includes the popular 7(a) loan program, has long been a lifeline for small businesses, providing much-needed capital to entrepreneurs who might otherwise struggle to secure funding. Critics of the proposal argue that ending this program could stifle small business growth and job creation. However, proponents suggest that private sector alternatives could fill the gap, potentially offering more efficient and innovative lending solutions.

The Heritage Foundation, a prominent conservative think tank, has played a pivotal role in drafting these proposals. Known for its advocacy of free-market principles, limited government, and individual liberty, the Heritage Foundation has been instrumental in shaping various policy reforms. The foundation’s involvement in Project 2025 underscores its influence in crafting recommendations that align with its core values.

As a new administration prepares to take the reins, the potential influence of Project 2025’s recommendations cannot be overlooked. Here are a few ways their proposals could shape future policy:

-

Regulatory Shifts:

The incoming administration may adopt a more deregulatory stance, aiming to reduce the burden on small businesses.

-

Privatization Push:

There could be a stronger emphasis on privatizing certain government functions, including lending programs.

-

Economic Policy Direction:

The recommendations could steer economic policy towards a more market-driven approach, with a focus on encouraging private sector solutions.

Rural Communities at Risk

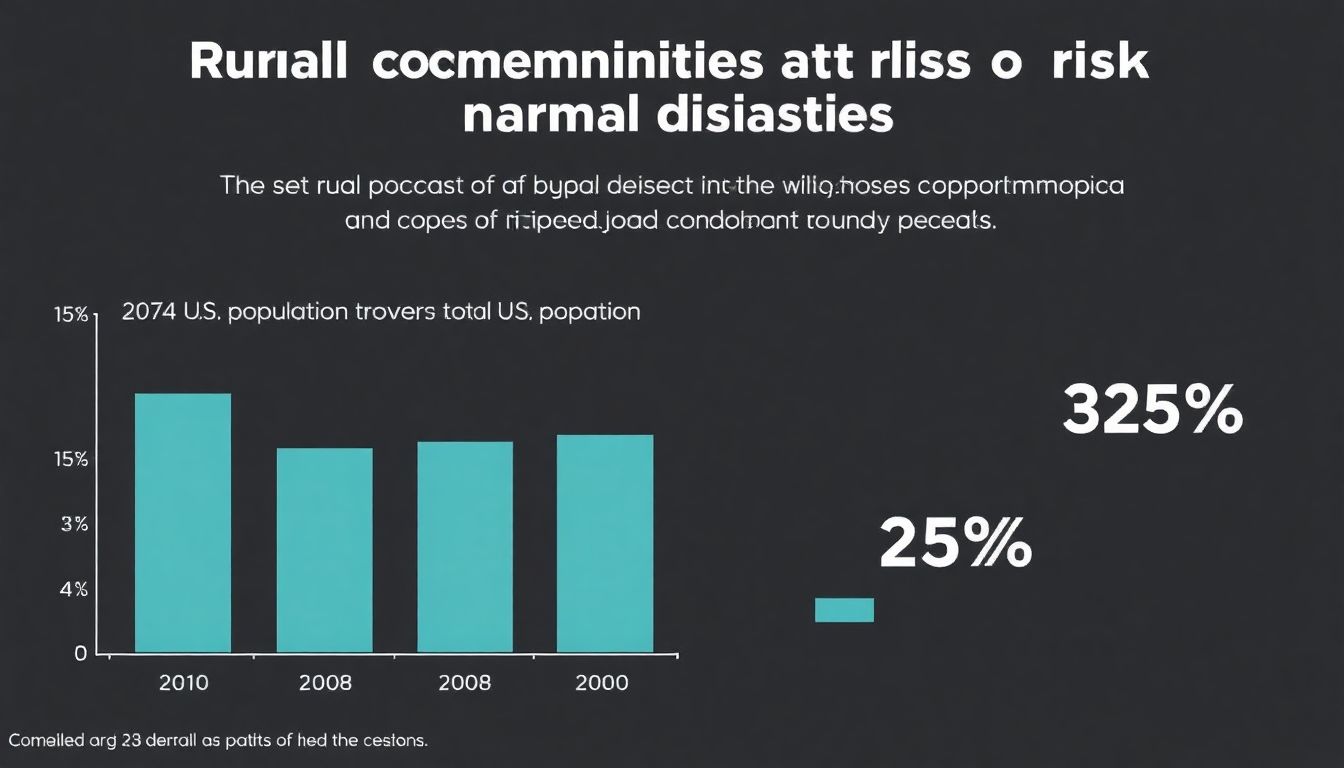

Rural communities often bear the brunt of natural disasters due to a combination of factors that increase their vulnerability. According to the United Nations, rural areas are home to a significant portion of the world’s poor, who are more likely to live in substandard housing and lack access to critical infrastructure. With limited resources for early warning systems, emergency response services, and disaster recovery efforts, rural communities are often ill-equipped to handle the onslaught of natural disasters. Dr. John Twigg, a renowned expert on disaster risk reduction, notes that the rural poor are disproportionately affected by disasters due to their isolation, lack of access to information, and limited institutional support

.

The statistics paint a stark picture. A Federal Emergency Management Agency report found that rural counties in the United States have a higher mortality rate from natural disasters than their urban counterparts. Furthermore, a study by the Economic Research Service revealed that rural areas experienced nearly twice as many presidential disaster declarations as urban areas from 1998 to 2017. This disparity underscores the need for targeted intervention and support for rural communities.

Enter the Small Business Administration’s (SBA) direct lending program, a lifeline for rural communities grappling with the aftermath of natural disasters. The program offers low-interest loans to businesses, homeowners, and renters in declared disaster areas, providing much-needed financial relief. As of 2023, the SBA has approved over $70 billion in disaster loans, with a significant portion benefiting rural areas. The SBA’s direct lending program has been instrumental in helping rural communities recover and rebuild after disasters,

says James Rivera, associate administrator for the SBA’s Office of Disaster Assistance.

The SBA’s efforts have not gone unnoticed. Recipients of SBA disaster loans have reported several benefits, including:

- Immediate access to funds for repairs and rebuilding

- Flexible repayment terms that consider individual circumstances

- Comprehensive assistance for both physical and economic damage

. These benefits have been crucial in helping rural communities bounce back from disasters, ensuring their long-term resilience and sustainability. By providing targeted financial support, the SBA’s direct lending program is bridging the gap between rural communities and the resources they need to recover and thrive.

The Increasing Threat of Natural Disasters

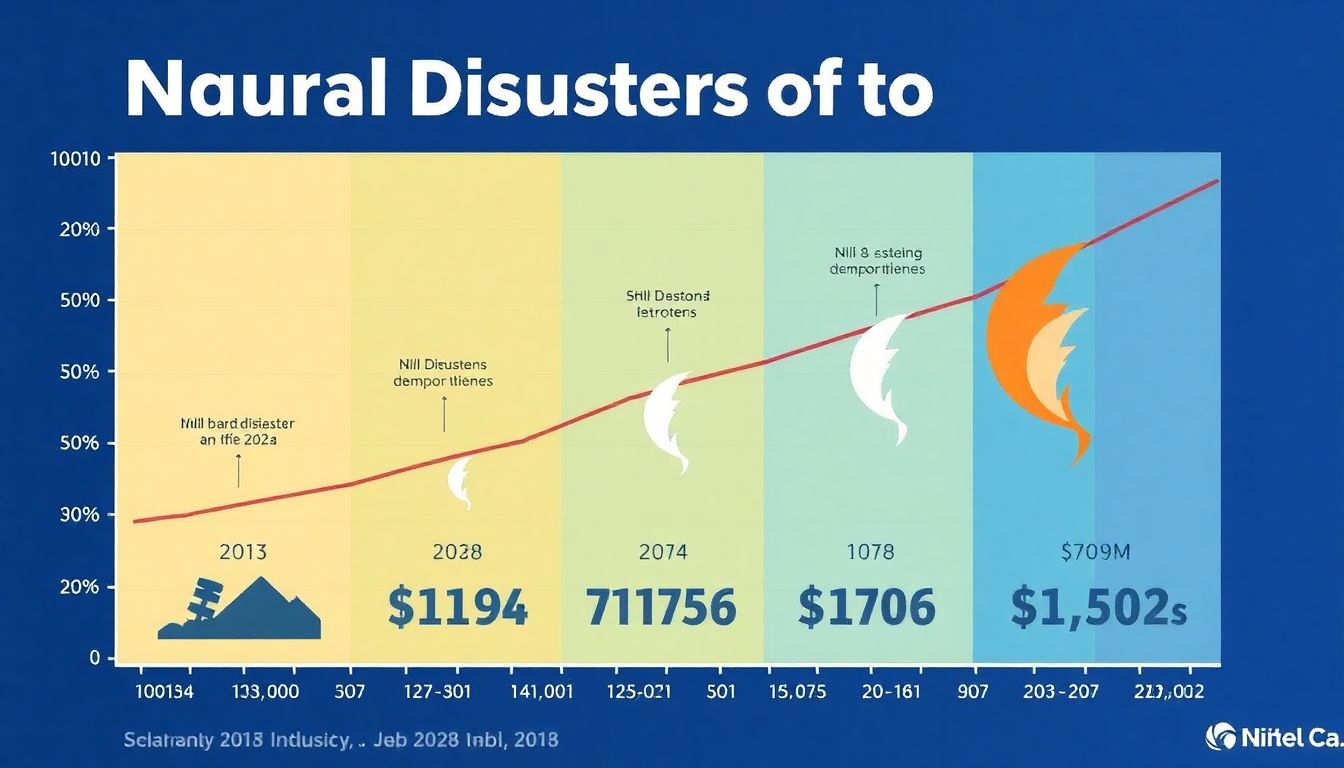

The escalating frequency and intensity of natural disasters, driven by climate change, have become a pressing global concern. As temperatures continue to rise, storms are becoming more destructive and costly, wreaking havoc on communities worldwide. Scientists have warned that for every degree Celsius of warming, the atmosphere can hold about 7% more moisture, leading to heavier downpours and more intense storms. This phenomenon has led to a significant increase in flooding, storm surges, and wind damage, affecting both coastal and inland regions.

The economic impact of these events is staggering. In the United States alone, the cost of natural disasters has been rising exponentially. According to the National Oceanic and Atmospheric Administration (NOAA), the total cost of billion-dollar weather and climate disasters in the U.S. reached a record $99 billion in 2020. These costs include infrastructure damage, agricultural losses, and disruptions to business operations. Moreover, the long-term effects on communities, such as displacement and economic downturns, are often immeasurable.

Communities rely heavily on Small Business Administration (SBA) disaster loans to recover and rebuild in the aftermath of these events. However, the increasing frequency and intensity of natural disasters are putting a strain on these resources. Here’s how:

- Increased demand: As disasters become more frequent, the demand for SBA disaster loans surges, leading to potential delays and backlogs in processing applications.

- Limited resources: The SBA has a finite amount of funds allocated for disaster loans. With more intense and costly disasters, these funds can be quickly depleted, leaving some communities without adequate support.

- Longer recovery times: More destructive storms mean more severe damage, requiring more time and resources to rebuild. This can prolong the recovery process, putting additional strain on local economies.

The Uncertain Future of Disaster Relief

Project 2025, a comprehensive study by the National Infrastructure Advisory Council, proposes sweeping recommendations to address the nation’s aging infrastructure. If implemented, these recommendations could significantly bolster America’s resilience to disasters. We can expect to see:

- Improved communications infrastructure, ensuring first responders can effectively coordinate during emergencies.

- Fortified transportation networks, facilitating swift evacuations and efficient delivery of relief supplies.

- Enhanced grid stability, minimizing power outages and expediting recovery efforts.

However, the implementation of these proposals hinges on the support of the incoming administration. President-elect Trump’s track record on disaster relief is varied. While he has declared states of emergency and approved federal aid for disaster-struck areas, there have been instances where his administration has faced criticism. For instance, the response to Puerto Rico’s Hurricane Maria was widely panned for being slow and inadequate. Given this mixed history, it’s uncertain whether Trump will fully embrace the Project 2025 recommendations.

One of the most contentious proposals is the potential elimination of the Small Business Administration’s (SBA) disaster lending program. Rural communities, which are often the most financially vulnerable, rely heavily on this program for recovery efforts. Experts warn that removing this lifeline could have devastating consequences. Dr. Louise Comfort, a renowned expert in disaster management, argues that “Rural communities lack access to diverse financial resources. The SBA lending program is often their sole means of recovery.” She further emphasizes that “Without this program, rural communities would face prolonged recovery periods, increased poverty rates, and even permanent displacement.”

Moreover, the elimination of the SBA lending program could create a ripple effect, straining other disaster relief systems. Dr. Ron Kendig, a disaster policy specialist, warns that “The increased burden on FEMA and other federal agencies could lead to delayed response times, inefficient resource allocation, and ultimately, a lower quality of support for affected communities.” Thus, the adoption of the Project 2025 recommendations, while promising in many aspects, could also present substantial challenges if not approached thoughtfully.

FAQ

What is the Small Business Administration’s direct lending program?

Why are rural communities more vulnerable to natural disasters?

How has climate change affected the frequency and intensity of natural disasters?

What is Project 2025 and who drafted its recommendations?

What could be the impact on rural communities if the SBA’s direct lending program is eliminated?

- Increased financial vulnerability for rural communities post-disaster.

- Potential lack of support for businesses, homeowners, renters, and nonprofit organizations.

- Greater reliance on insurance and FEMA payouts, which may not cover all financial losses.