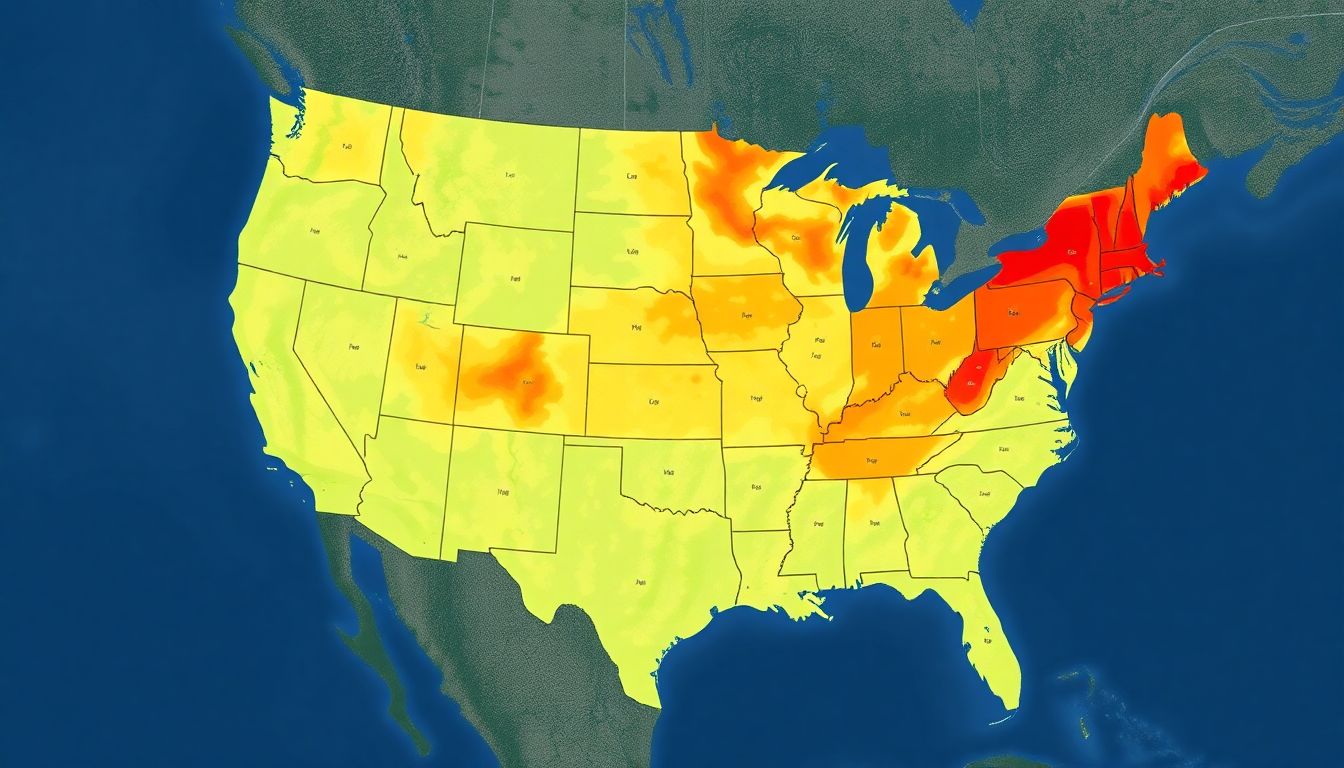

In the wake of increasingly frequent and severe natural disasters, rural communities have been grappling with a harsh reality: the financial burden of recovery can be as devastating as the disaster itself. According to the National Institute of Building Sciences, between 2010 and 2019, rural areas accounted for 30% of all disaster declarations, yet they received only 15% of the total disaster relief funding. This disparity has led to a pressing need for innovative financial relief solutions tailored to rural communities. One such solution, the Lending Program for Natural Disaster Relief, is now under threat, as it faces potential cuts under Project 2025 recommendations.

But why is this program so crucial, and what does its potential demise mean for rural communities? This article aims to shed light on the importance of this lending program, the challenges faced by rural communities in disaster risk management, and the potential impact of Project 2025’s recommendations. By the end of this piece, readers will not only understand the significance of this program but also gain practical insights into how rural communities can prepare for and mitigate the financial impacts of natural disasters.

Let’s start by agreeing that access to affordable credit is a lifeline for rural communities in the aftermath of natural disasters. This lending program, administered by the Small Business Administration (SBA), has been a beacon of hope for countless rural businesses and homeowners, providing low-interest loans to help them rebuild and recover. Now, let’s promise to explore the reasons behind Project 2025’s recommendations and their potential consequences. Lastly, let’s preview the strategies and steps rural communities can take to enhance their disaster resilience and financial preparedness, ensuring they are not left high and dry when the next storm hits.

Ted Lemoi’s Story: A Cautionary Tale as SBA Disaster Loans Face Uncertainty

In the quiet town of Bridgeville, nestled between the rolling hills and the whispering woods, lived Ted Lemoi, a man known for his resilience and resourcefulness. Ted was no ordinary resident; he was a prepper, a term he wore with pride. He had spent years preparing for the unexpected, stockpiling supplies, learning essential skills, and fortifying his home. His neighbors often dismissed him as overly cautious, but Ted simply smiled and said, ‘Better safe than sorry.’

One fateful day, a sudden and devastating storm swept through Bridgeville. Trees were uprooted, homes were destroyed, and the town was left in shambles. Ted’s home, though battered, stood strong, a testament to his meticulous preparations. While his neighbors scrambled to find shelter and supplies, Ted was able to provide aid, offering food, water, and a safe haven. He was a beacon of hope in the chaos.

In the aftermath, Ted, like many others, turned to the Small Business Administration (SBA) for disaster loans to help rebuild. The SBA, known for its low-interest loans and flexible terms, was a lifeline for many. However, as Ted waited for his loan approval, he began to hear whispers of uncertainty. The SBA’s budget was stretched thin, and there were rumors of funding cuts and changes in policy. Ted, with his prepper instincts tingling, decided not to rely solely on the SBA. He started exploring other funding options, reaching out to local charities, crowdfunding platforms, and even considering a part-time job to supplement his income.

Ted’s story serves as a cautionary tale for preppers and non-preppers alike. While it’s crucial to prepare for the worst, it’s equally important to have a Plan B, C, and even D. Relying on a single source of aid, whether it’s the government, a charity, or a family member, can leave you vulnerable. Diversify your preparations, stay informed about potential changes in policy, and always be ready to adapt. After all, as Ted would say, ‘The best-laid plans often go awry, but it’s how you adapt that truly matters.’

The Lifeline of SBA Disaster Loans

When natural disasters strike, rural communities often bear the brunt of the destruction. These communities, with their unique challenges and limited resources, need all the help they can get to recover and rebuild. This is where the U.S. Small Business Administration’s (SBA) Disaster Loan Program steps in, serving as a lifeline for countless communities across the nation.

The SBA offers low-interest disaster loans to homeowners, renters, and businesses of all sizes to repair or replace real estate, personal property, machinery, and equipment, inventory, and business assets that have been damaged or destroyed in a declared disaster. This includes losses due to flooding, fire, wind, and other natural disasters.

Eligibility for these loans is not limited to businesses; individuals and nonprofits can also apply. To qualify, one must be located in a declared disaster area, be unable to obtain credit elsewhere, and have suffered disaster-related damage. The loan amount and terms are determined by the SBA based on the applicant’s financial needs and ability to repay.

In recent years, states like Florida, Texas, and Louisiana have been no strangers to natural disasters. These states have benefited greatly from the SBA’s disaster loan program. For instance, following Hurricane Harvey in 2017, the SBA approved over $1.2 billion in disaster loans for Texas residents and businesses. Similarly, after Hurricane Michael devastated Florida’s Panhandle in 2018, the SBA approved over $700 million in disaster loans for the state’s recovery efforts. In Louisiana, the SBA has been a crucial support for communities affected by hurricanes, floods, and other natural disasters, approving millions of dollars in disaster loans over the years.

In essence, the SBA’s Disaster Loan Program is not just about providing financial assistance; it’s about empowering communities to rebuild, recover, and become more resilient. It’s about giving hope to those who have lost everything, and helping them get back on their feet. It’s about turning disaster into opportunity for growth and renewal.

Rural Communities: Disproportionately Affected, Less Resourced

Rural Communities: Disproportionately Affected, Less Resourced

Project 2025: A Threat to Post-Disaster Financial Relief

Project 2025: A Threat to Post-Disaster Financial Relief

Trump’s Affiliation with Heritage Foundation: A Cause for Concern

Trump’s Affiliation with Heritage Foundation: A Cause for Concern

A History of Denied Disaster Declarations

Detail Trump’s track record of denying disaster declaration requests, using examples from Pennsylvania and North Carolina. Discuss the potential impact of this trend on rural communities if Project 2025’s recommendations are implemented.

Preparing for the Worst: How Rural Communities Can Cope

Preparing for the Worst: How Rural Communities Can Cope

Advocating for Change: What You Can Do

In the face of challenges that disproportionately affect rural communities, it’s crucial to remember that collective action can drive significant change. By standing together and raising our voices, we can influence policy decisions and ensure that our unique needs are addressed. Here’s how you can make a difference:

The first step is to educate yourself about the issues at hand. Stay informed about the challenges your community is facing, and understand the policies that could help or hinder progress. This knowledge will empower you to communicate effectively with your representatives and fellow community members.

Once you’re well-versed in the issues, it’s time to take action. Contacting your representatives is a powerful way to make your voice heard. Write letters, make phone calls, or schedule meetings to express your concerns and advocate for change. Remember, they work for you, and your input is invaluable.

Raising awareness is another critical aspect of advocating for change. Share your knowledge with friends, family, and neighbors. Host community meetings, start a local advocacy group, or use social media to spread the word. The more people who understand and care about the issues, the louder our collective voice becomes.

Supporting organizations that advocate for rural communities is another effective way to drive change. These groups often have the resources and expertise to lobby policymakers and influence legislation. By donating your time or money, you’re amplifying your voice and helping to build a stronger movement.

Finally, don’t forget the power of collective action. When we come together, we’re a force to be reckoned with. Join forces with other rural communities, form coalitions, and collaborate on advocacy efforts. Together, we can ensure that our voices are heard and that our needs are met.

FAQ

What is the Lending Program for Natural Disaster Relief and why is it important?

How do SBA loans differ from other disaster relief funds?

What types of SBA loans are available for disaster relief?

- Home and Personal Property Loans: These loans help homeowners and renters repair or replace damaged or destroyed real estate and personal property.

- Business Physical Disaster Loans: These loans help businesses of all sizes repair or replace damaged or destroyed property, including real estate, machinery, equipment, inventory, and supplies.

- Economic Injury Disaster Loans (EIDL): These loans provide working capital to small businesses, small agricultural cooperatives, and most private nonprofits to meet their ordinary and necessary financial obligations that they cannot meet due to the disaster’s impact.

- Military Reservists Economic Injury Disaster Loans (MREIDL): These loans provide funds to eligible small businesses to meet their ordinary and necessary operating expenses that they would have met if the essential employee had not been called up to active duty in the Armed Forces.

Why are rural communities particularly at risk from natural disasters?

What are the Project 2025 recommendations, and how do they relate to natural disaster relief?

How can rural communities prepare for natural disasters to minimize the need for financial relief?

- Develop and maintain an emergency plan: This should include evacuation routes, emergency supply kits, and communication plans.

- Strengthen infrastructure: This can involve improving roads, bridges, and drainage systems to better withstand disasters.

- Implement nature-based solutions: Preserving and restoring natural features, like wetlands and forests, can help reduce the impact of disasters.

- Improve access to insurance: Encourage residents and businesses to purchase insurance that covers natural disasters.

- Educate the community: Provide training and education on disaster preparedness and response.

What steps can small businesses take to prepare for natural disasters and access SBA loans if needed?

- Create a business continuity plan: This should include steps to protect employees and customers, maintain critical business functions, and restore operations as quickly as possible.

- Document important records: Keep copies of important records, including insurance policies, licenses, and permits, off-site or in a secure cloud-based system.

- Purchase insurance: Consider purchasing insurance that covers natural disasters.

- Stay informed: Stay up-to-date on local weather and disaster information.

- Apply for an SBA loan as soon as possible after a disaster: The application process can take time, and waiting too long can delay recovery efforts.

How can individuals prepare for natural disasters to minimize the need for financial relief?

- Create an emergency supply kit: This should include enough food, water, and other supplies to last at least 72 hours.

- Develop an emergency plan: This should include evacuation routes, emergency meeting places, and communication plans.

- Purchase insurance: Consider purchasing insurance that covers natural disasters.

- Stay informed: Stay up-to-date on local weather and disaster information.

- Document important records: Keep copies of important records, including insurance policies, identification, and bank account information, off-site or in a secure cloud-based system.

What can be done to ensure that rural communities have equal access to natural disaster financial relief?

- Improve access to technology: Many disaster relief resources are now available online, but rural communities may have limited internet access. Improving broadband access can help ensure that rural residents can access these resources.

- Provide outreach and education: Many rural residents may not be aware of the disaster relief resources available to them. Providing outreach and education can help ensure that they know how to access these resources.

- Simplify the application process: The application process for disaster relief can be complex and time-consuming. Simplifying this process can help ensure that rural residents can access the relief they need.

- Provide additional support: Rural communities may need additional support to access disaster relief, such as assistance with the application process or help navigating the system. Providing this support can help ensure that rural residents can access the relief they need.