Welcome to this in-depth exploration of the recent jet crash disaster in Korea, its implications for Boeing, and the broader context of the aviation giant’s challenges. This article will delve into the details of the incident, the company’s recent setbacks, and the broader implications for the aviation industry. Join us as we navigate through this complex story with a blend of serious analysis and engaging insights.

A Look into Boeing’s Turbulent Year and the Impact of the Recent Tragedy

Imagine the stark contrast of a once-soaring vessel now laid low, a crumpled metal giant resting on the rain-soaked tarmac of Muan International Airport. The fuselage, once a symbol of human innovation and freedom, now lies in pieces, a grim monument to the unpredictable nature of flight. The air is thick with the acrid smell of jet fuel and the distant wail of sirens, as emergency vehicles race towards the wreckage, their lights flashing urgently against the dreary backdrop of an overcast sky.

Fire trucks, ambulances, and ambulances converge on the scene, their tires screeching against the wet pavement as they form a desperate perimeter around the crashed airplane. Teams of first responders, clad in bright yellow jackets, swarm the site, their urgent shouts cutting through the damp air. They move with a practiced efficiency, some rushing to tend to the passengers, others battling the fierce flames that lick at the twisted metal, trying to contain the chaos and prevent further destruction.

Above, the sky churns with a dark, ominous energy, reflecting the somber mood below. The clouds, heavy with unshed rain, seem to press down on the scene, as if nature itself is mourning the tragic event. The occasional rumble of thunder serves as a grim reminder of the powerful forces at play, both natural and man-made, that have conspired to bring this metal giant to its knees.

The Crash: A Tragic End to a Tumultuous Year

On October 21, 2023, a cargo jet crashed into the sea off the coast of Jeju Island, South Korea, marking a significant aviation incident that sent ripples through the industry. The jet, a Boeing 737, was operating a routine cargo flight when it abruptly lost contact with air traffic control and plummeted into the waters below. The location, Jeju Island, is a popular tourist destination known for its beautiful beaches and volcanic landscape, making the event all the more jarring for locals and visitors alike.

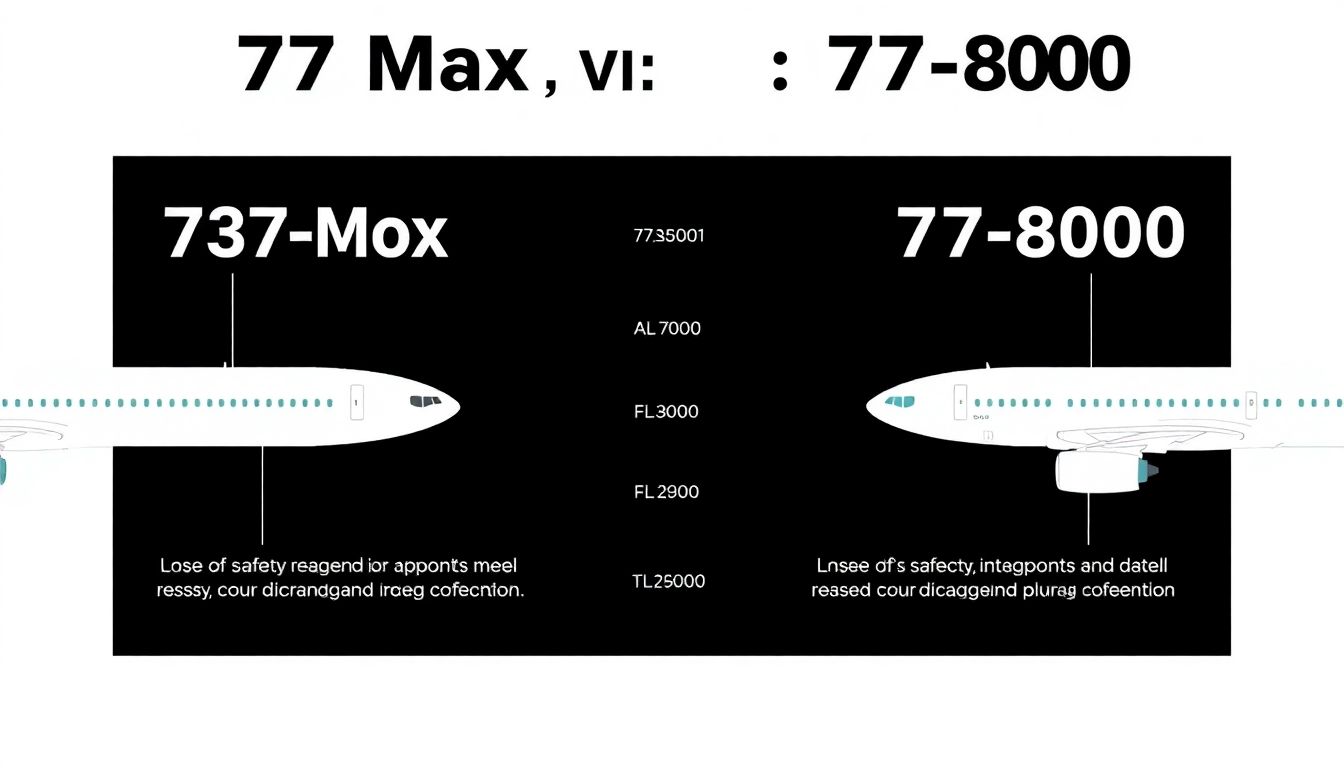

This crash comes at a particularly challenging time for Boeing, which has already been grappling with a series of setbacks and controversies. The year had been marked by ongoing investigations and groundings related to the 737 Max, a passenger jet model involved in two fatal crashes in 2018 and 2019. These incidents led to a worldwide grounding of the 737 Max fleet, causing significant financial and reputational damage to the company.

However, it is crucial to note the distinction between the recent cargo jet crash and the previous issues with the 737 Max. The 737 Max crashes were attributed to a faulty flight control system, known as the Maneuvering Characteristics Augmentation System (MCAS), which was not present in the cargo jet that crashed off Jeju Island. This differentiation is important as it highlights that the recent incident may not be directly linked to the systemic problems that plagued the 737 Max.

The impact of this crash on Boeing’s already challenging year is multifaceted. Here are some key points to consider:

-

Reputation:

The incident could further dent Boeing’s reputation, which has been slowly recovering from the 737 Max crises.

-

Financial Implications:

The crash could lead to additional financial strain, including potential lawsuits, investigation costs, and compensation payments.

-

Regulatory Scrutiny:

Boeing will likely face increased scrutiny from aviation regulators worldwide, which could affect the timeline and processes for approving and delivering new aircraft.

-

Customer Confidence:

Airlines and cargo operators may reassess their orders and commitments to Boeing, potentially impacting future sales and market share.

Boeing’s Year of Setbacks

The year 2024 proved to be an unprecedented challenge for aerospace giant Boeing, as it faced a series of setbacks that shook the company to its core. The first major hurdle was the machinists’ strike, which began in the early months of the year. Over 35,000 workers took to the picket lines, demanding better wages and benefits. The strike, which was one of the largest in recent history, brought production to a grinding halt, leading to delays in aircraft deliveries and a backlog of orders. The most significant impact was on the 737 MAX and 787 Dreamliner programs, which are crucial to Boeing’s commercial aviation segment.

Concurrently, Boeing was grappling with severe safety issues. Despite efforts to restore confidence in its 737 MAX aircraft after the 2019 grounding, new concerns emerged. Reports surfaced of potential electrical problems and other technical glitches, leading to further scrutiny from aviation regulators worldwide. These safety issues not only resulted in additional groundings and delivery pauses but also tarnished Boeing’s reputation for quality and reliability. The company’s once-sterling image began to falter, as airlines and passengers alike expressed growing concern over the safety of Boeing’s aircraft.

Adding to Boeing’s woes was the plunging stock price. Investors, spooked by the strike and safety issues, began selling off their shares at an alarming rate. Within the first half of the year, Boeing’s stock price plummeted by over 40%, wiping out billions of dollars in market capitalization. This financial downturn had a cascading effect on the company’s operations, forcing Boeing to implement cost-cutting measures and reevaluate its strategic plans. The financial strain also raised questions about Boeing’s ability to innovate and compete in the rapidly evolving aerospace market.

The cumulative impact of these setbacks on Boeing’s reputation and financial status was devastating. The company, once seen as a pillar of American manufacturing and a global leader in aerospace, found itself in a precarious position. The machinists’ strike, safety issues, and plunging stock price collectively eroded trust in the brand, both among industry stakeholders and the general public. Boeing’s leadership faced intense pressure to turn the situation around, with calls for significant reforms and a renewed focus on safety and quality. The road to recovery for Boeing in 2024 was fraught with challenges, but the company remained determined to rebuild its reputation and regain its footing in the aerospace industry.

The 737 Max Controversy

The aviation world was rocked by two catastrophic crashes involving the Boeing 737 Max aircraft in 2018 and 2019. On October 29, 2018, Lion Air Flight 610 plunged into the Java Sea just 13 minutes after takeoff, resulting in the loss of all 189 passengers and crew. Less than five months later, on March 10, 2019, Ethiopian Airlines Flight 302 met a similar fate when it crashed six minutes after taking off from Addis Ababa, killing all 157 people on board. Both accidents were linked to a faulty flight control system known as the Maneuvering Characteristics Augmentation System (MCAS), which was designed to prevent the aircraft from stalling but instead forced the planes into unrecoverable nosedives.

These tragedies sparked global safety concerns about the 737 Max aircraft. Investigations revealed that Boeing had not properly informed pilots about the MCAS system, leading to calls for improved transparency and training. Furthermore, questions were raised about the certification process that allowed the 737 Max to enter service, with critics arguing that the Federal Aviation Administration (FAA) had delegated too much authority to Boeing during the approval process. In response to these concerns, aviation regulators worldwide grounded the 737 Max fleet in March 2019, leading to a lengthy global grounding and intense scrutiny of Boeing’s safety practices.

Boeing has faced a barrage of legal and regulatory challenges in the wake of the crashes. Multiple lawsuits were filed by families of the victims, alleging that Boeing’s negligence led to the accidents. The company also faced investigations by the U.S. Department of Justice (DOJ) and other regulatory bodies. In January 2021, Boeing agreed to pay over $2.5 billion in fines and compensation as part of a deferred prosecution agreement with the DOJ. The agreement included a criminal penalty of $243.6 million, compensation of $1.77 billion to airlines, and a crash-victim beneficiaries fund of $500 million. However, the legal saga took a dramatic turn in late 2023 when a federal judge rejected the plea deal, citing concerns that it did not go far enough in holding Boeing accountable for its actions.

The rejection of the plea deal has left Boeing in a state of uncertainty, with several potential outcomes on the horizon:

- The DOJ could pursue a new agreement with stricter terms and higher penalties.

- The case could proceed to a criminal trial, which would be a lengthy and complex process.

- Boeing could face additional civil lawsuits and regulatory actions, further damaging its reputation and financial stability.

As the legal drama unfolds, the aviation industry continues to grapple with the far-reaching implications of the 737 Max crashes, with a focus on enhancing safety standards and regulatory oversight to prevent similar tragedies in the future.

Boeing’s Path to Recovery

In the wake of recent high-profile incidents, Boeing is taking monumental steps to prioritize safety and restore its standing in the aviation industry. The company has initiated a comprehensive overhaul, starting with a significant change in leadership. New CEO David Calhoun has taken the helm, bringing a fresh perspective and a commitment to transparency and integrity. Calhoun has been vocal about his dedication to rebuilding trust, ensuring that Boeing’s culture is rooted in safety and quality.

One of the most critical steps Boeing has taken is the implementation of employee safety meetings. These forums encourage open dialogue among employees, fostering an environment where safety concerns can be voiced without fear of retribution. By empowering employees to speak up, Boeing is cultivating a culture of collective responsibility, where every team member plays a crucial role in upholding the highest safety standards. This shift is not just about policy; it’s about creating a genuine cultural change that permeates every level of the organization.

Boeing’s efforts extend beyond internal meetings and leadership changes. The company is undergoing broader cultural shifts aimed at reinforcing its commitment to safety and innovation. This includes:

- Enhancing communication channels to ensure that all employees feel heard and valued.

- Investing in advanced training programs to equip employees with the latest knowledge and skills.

- Strengthening relationships with regulatory bodies to ensure compliance and transparency.

These initiatives are part of Boeing’s larger strategy to rebuild its reputation and regain the trust of its customers and the flying public. By addressing safety issues head-on and fostering a culture of openness and accountability, Boeing is not only working to rectify past mistakes but also laying the groundwork for a safer, more reliable future in aviation.

FAQ

What caused the jet crash in Korea?

What were the major setbacks for Boeing in 2024?

- A machinists’ strike that lasted seven weeks

- Safety issues, including a door plug blowing off a 737 Max during flight

- A plunging stock price, down more than 30 percent

- Legal and regulatory challenges related to the 737 Max