In the dynamic landscape of 2024, the term ‘prepping’ has evolved far beyond stockpiling canned goods and building underground bunkers. As we’ve witnessed an unprecedented array of natural disasters, cyber threats, and global health crises, the need for comprehensive, innovative disaster insurance has never been more pressing. But what does this evolution entail, and how can we, as individuals and communities, ensure we’re adequately prepared for the challenges that lie ahead?

Consider this: in 2023 alone, natural disasters caused an estimated $268 billion in damages worldwide, displacing millions and claiming thousands of lives (EM-DAT). Meanwhile, the global cost of cybercrime is projected to reach $10.5 trillion by 2025 (Cybersecurity Almanac). These staggering figures underscore a harsh reality: traditional insurance models are struggling to keep pace with the escalating risks of our interconnected world.

So, how can we adapt? How can we, as responsible preppers, ensure our survival and that of our loved ones in the face of these daunting challenges? This article, drawing from expert insights and cutting-edge innovations, aims to answer these very questions. We’ll delve into the intricacies of the evolving disaster insurance landscape, exploring the challenges we face and the innovative solutions that are reshaping the way we prep and protect ourselves. By the end of this piece, you’ll have a clear understanding of the shifting insurance paradigm and practical strategies to enhance your survival preparedness in 2024 and beyond.

But first, let’s address the elephant in the room: are you confident that your current insurance coverage is sufficient to weather the storms

- both literal and digital

- of tomorrow? If not, you’re not alone. A recent survey by the World Economic Forum revealed that only 37% of respondents felt their organizations were adequately prepared for high-impact, low-probability events. This article is here to change that, to empower you with the knowledge and tools necessary to navigate the complex, ever-evolving world of disaster insurance and preppering for the unexpected.

Navigating the New Normal: Prepping for Climate-Driven Disasters in 2024

As we step into 2024, the reality of climate change is no longer a distant threat but a present-day challenge. Extreme weather events, rising sea levels, and shifting precipitation patterns are becoming the new normal, making it crucial for us to adapt and prepare. Prepping, once seen as an eccentric hobby, is now a responsible and necessary practice for many households worldwide. This article aims to guide you through the process of prepping for climate-driven disasters, ensuring you and your loved ones are ready to face the challenges that lie ahead.

Firstly, it’s essential to understand the unique climate risks in your area. Is your region prone to hurricanes, wildfires, droughts, or flooding? Knowledge is power, and the more informed you are about the specific threats you face, the better equipped you’ll be to prepare. Stay updated with local news, weather alerts, and consider installing weather apps that provide real-time updates.

Once you’ve identified the potential hazards, it’s time to create an emergency plan. This should include evacuation routes, emergency meeting points, and a communication plan to stay in touch with family members during a crisis. It’s also crucial to have an emergency kit stocked with essential supplies like water, non-perishable food, a first aid kit, important documents, and any necessary medications. Remember, the key to a successful emergency plan is practice. Conduct regular drills to ensure everyone in your household knows what to do when disaster strikes.

Prepping also involves making your home more resilient. This could mean installing hurricane shutters, creating defensible space around your home to protect against wildfires, or elevating your home to mitigate flood damage. Additionally, consider investing in renewable energy sources and energy-efficient appliances to reduce your carbon footprint and prepare for potential power outages.

Lastly, it’s important to stay connected with your community. Join local preparedness groups, attend community meetings, and volunteer for community service. A strong, prepared community is a resilient community, and by working together, we can better face the challenges posed by climate change. So, let’s embrace the new normal, not with fear, but with resilience, preparation, and a sense of community. After all, we’re all in this together, and together, we can navigate the road ahead.

Understanding the Evolving Landscape

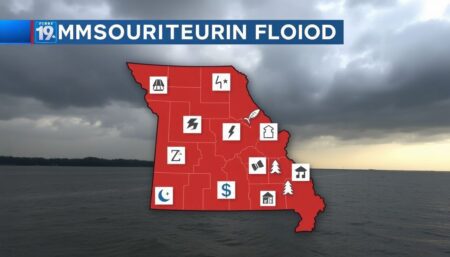

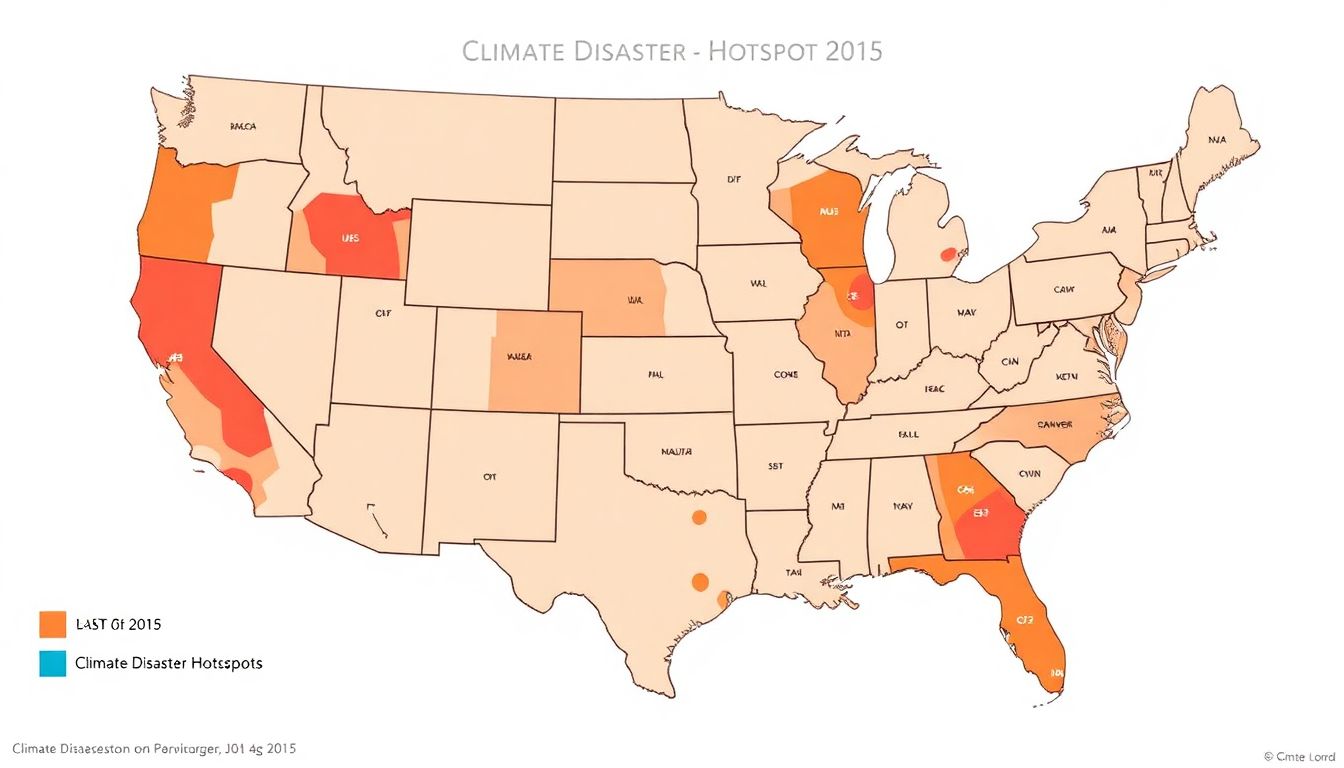

The climate crisis is no longer a distant threat, but a present reality that’s reshaping our world at an alarming pace. We’re witnessing a surge in climate-driven disasters, with wildfires and flooding becoming increasingly frequent and severe. According to the National Oceanic and Atmospheric Administration, the U.S. has already incurred over $100 billion in damages from climate-related disasters this year alone.

The insurance industry, a cornerstone of disaster recovery, is grappling with this new normal. Traditional models are being challenged as these events become more intense and unpredictable. Gaps in coverage are widening, leaving many homeowners and businesses vulnerable.

Insurers are scrambling to adapt. They’re developing innovative tools and strategies to assess and manage risks in this rapidly changing landscape. This includes advanced modeling software to predict future hazards, and new insurance products tailored to climate change, such as parametric insurance that provides immediate payouts based on predefined event triggers.

However, these responses are not enough. It’s crucial for individuals and communities to take proactive steps to prepare for these events. This means understanding your local climate risks, implementing mitigation measures, and ensuring you have adequate insurance coverage. After all, while insurance can help us recover, it’s no substitute for being prepared in the first place.

The Insurance Industry’s Response

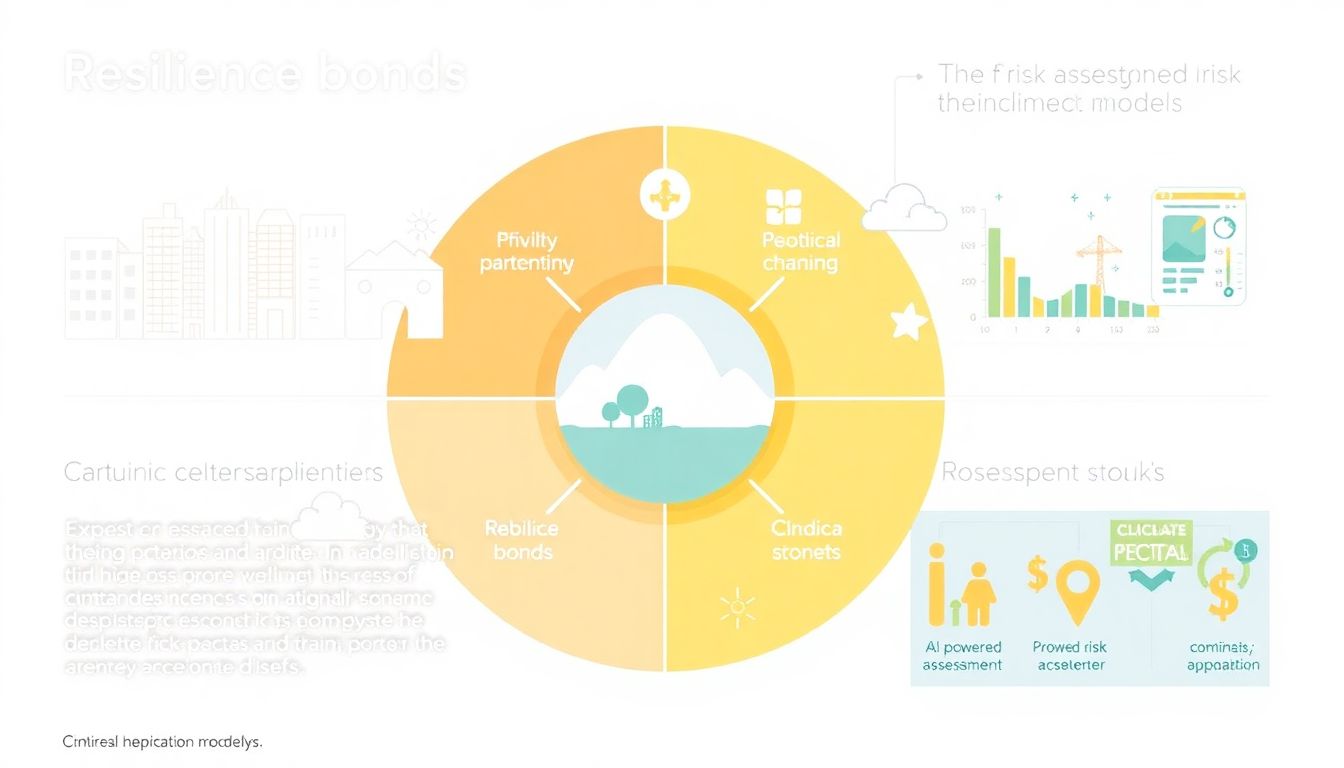

In the face of escalating climate risks, the insurance industry is not merely reacting, but proactively innovating to manage and mitigate these challenges. One such innovative solution is resilience bonds, a financial instrument that incentivizes climate risk reduction. Here’s how it works:

Insurers, along with other investors, pool funds to cover potential losses from climate events. If a predefined risk threshold is not met, the bond’s principal is returned with interest. However, if the threshold is exceeded, funds are released to support recovery and resilience efforts in the affected region. This not only helps in rebuilding infrastructure but also encourages proactive measures to enhance future resilience.

Public-private partnerships are another key strategy. Insurers collaborate with governments and other stakeholders to share resources and expertise. For instance, they can help in developing and implementing early warning systems, improving building codes, and promoting climate-smart insurance products. These partnerships foster a collective approach to risk management, benefiting all parties involved.

The insurance industry is also leveraging advanced technology to enhance its climate risk management capabilities. Artificial Intelligence (AI) and machine learning algorithms are used to analyze vast amounts of data, enabling insurers to better understand and predict climate risks. This helps in more accurate risk assessment, improved underwriting, and targeted investment in resilience measures.

Blockchain technology, meanwhile, is revolutionizing transparency and efficiency. It ensures secure, tamper-proof record-keeping of climate risk data, enabling better collaboration among insurers, reinsurers, and other stakeholders. Smart contracts can automate processes like claims settlement, reducing delays and costs.

In essence, these innovative solutions aim to shift the insurance industry’s role from merely compensating for losses to actively managing and mitigating climate risks. By doing so, they not only protect investors’ interests but also contribute to a more resilient and sustainable future.

Regulatory Pressures and Fairness in Pricing

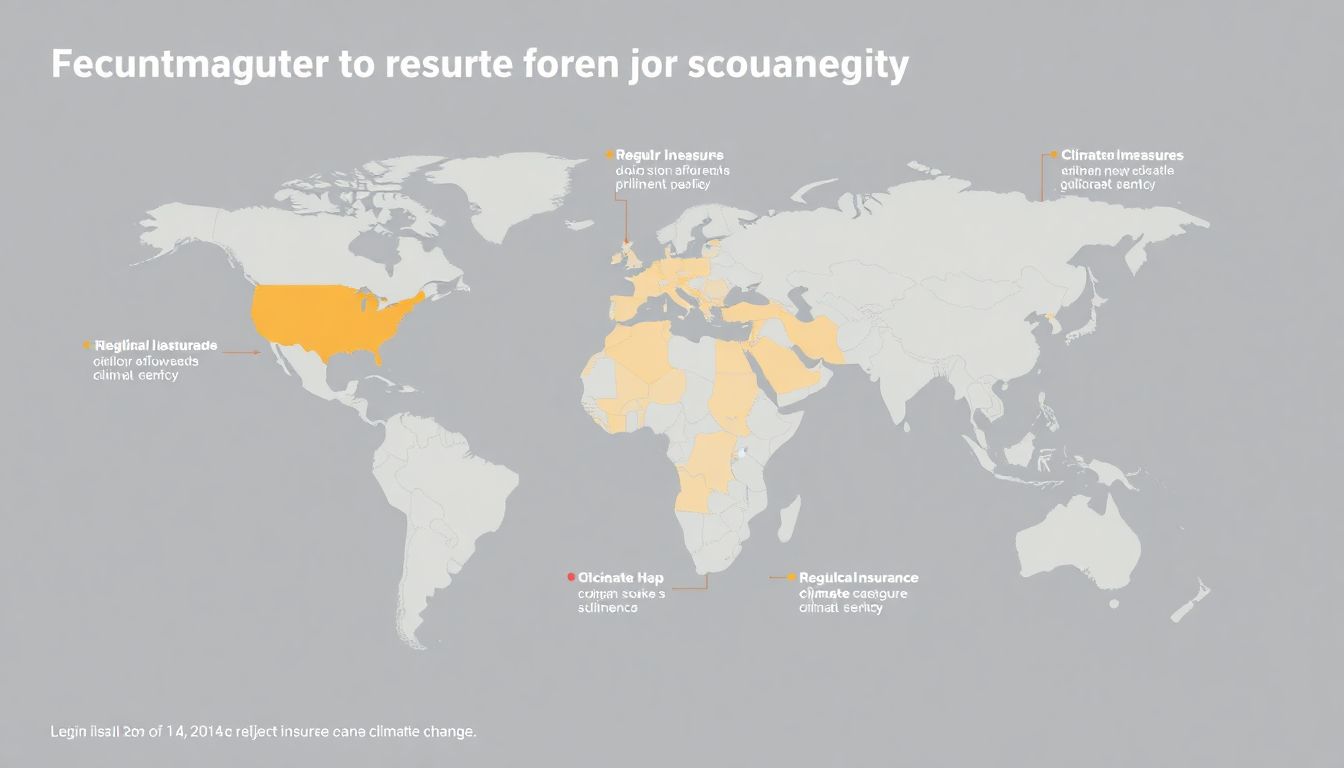

The insurance industry, much like the climate, is in a state of flux. As the world grapples with increasing weather-related risks, regulatory bodies are stepping in to ensure that insurers adapt and protect their policyholders. One of the key measures is mandatory climate disclosures. This requires insurers to publicly report their climate-related risks and opportunities, fostering transparency and encouraging better risk management. Another significant shift is risk-based pricing. Traditional flat-rate premiums are giving way to models that factor in individual risk profiles, making insurance more tailored and, ideally, fairer.

The introduction of subsidized insurance programs is also notable. These aim to make insurance more affordable for vulnerable communities and regions most exposed to climate change. However, striking a balance between fostering innovation and ensuring fairness in pricing is a delicate task. As highlighted in Oliver Wyman’s 2024 report, while risk-based pricing can drive innovation and improved risk management, it could also exacerbate affordability issues for high-risk policyholders. Therefore, regulators must ensure that these changes do not disproportionately burden those most affected by climate change. This balance is crucial for maintaining public trust in the insurance industry and its ability to protect people and businesses in a warming world.

Prepping for Survival: A Homeowner’s Guide

As homeowners, we have a unique responsibility to safeguard our homes and families from the ever-increasing threats posed by climate-driven disasters. From raging wildfires to devastating hurricanes, the need for proactive preparedness has never been more pressing. This guide will empower you to understand your individual climate risks, invest in predictive tools, and strengthen your personal resilience. Together, we can close the protection gap and ensure that no community is left vulnerable.

The first step in prepping for climate-driven disasters is to understand the specific risks your home faces. Research your location’s history of natural hazards, and stay informed about changing climate patterns. This knowledge will help you anticipate potential threats and make informed decisions about how to protect your property.

Investing in predictive tools is another crucial aspect of homeowner prepping. Weather forecasting technology has advanced significantly in recent years, providing us with increasingly accurate and timely information about impending disasters. Consider installing weather alert systems or apps that can notify you of severe weather conditions in your area. Additionally, investing in home security systems with integrated weather monitoring features can provide an extra layer of protection.

Strengthening personal resilience is essential for surviving climate-driven disasters. This involves creating an emergency plan for your family, assembling an emergency supply kit, and ensuring that your home is fortified against potential hazards. Consider installing impact-resistant windows, reinforcing your roof, and trimming trees that could potentially fall during severe weather. Additionally, familiarize yourself with your home’s utilities and learn how to shut them off in case of an emergency.

Working with your insurance provider is another important aspect of prepping for climate-driven disasters. Ensure that your home is adequately covered by reviewing your policy and making any necessary adjustments. Consider purchasing additional coverage for flood or earthquake damage, if applicable. Additionally, maintain open lines of communication with your insurer, and stay informed about any changes to your policy or coverage.

By taking these proactive steps, homeowners can significantly improve their chances of surviving climate-driven disasters. Together, we can build a more resilient future and ensure that no community is left behind.

Investing in Resilience: Infrastructure and Partnerships

Investing in Resilience: Infrastructure and Partnerships

The Future of Prepping: Embracing Change

In the dynamic landscape of climate change, the art of prepping is not a static pursuit but an evolving one. As we witness the increasing frequency and intensity of natural disasters, it’s clear that our strategies for resilience must adapt and grow with the changing climate. The first step in this journey is understanding our individual climate risks. This isn’t just about knowing if you live in a floodplain or a wildfire zone, but also about recognizing how your unique circumstances—your home’s construction, your family’s needs, your community’s resources—shape your vulnerabilities.

The next step is investing in predictive tools. This could mean anything from installing smart weather stations to monitor local conditions, to subscribing to advanced weather forecasting services, to using apps that send real-time alerts about hazards in your area. The more precise and timely our information, the better we can prepare.

But knowledge and information are only part of the equation. We must also embrace innovative solutions. This could mean retrofitting homes with renewable energy sources and energy-efficient appliances, or investing in green infrastructure like rain gardens and permeable pavement. It could mean exploring new forms of insurance, like parametric insurance, which provides immediate payouts when specific events occur, or community-based insurance models that pool resources and risks.

None of this can be achieved in isolation. Homeowners, insurers, and policymakers must work together to build a more resilient future. Homeowners can advocate for better building codes and zoning regulations, while insurers can offer discounts for resilient properties and invest in predictive analytics. Policymakers can incentivize resilience through tax breaks and grants, and can invest in public infrastructure that protects communities from climate risks.

In essence, the future of prepping is about more than just stockpiling supplies and building bunkers. It’s about understanding, adapting, and innovating in the face of a changing climate. It’s about working together to create a future that’s not just resilient, but also sustainable and equitable.

FAQ

What is the significance of ‘prepping’ in the context of disaster insurance in 2024?

How can I start prepping for disasters, especially if I’m new to the concept?

- Educate yourself about common disasters in your area.

- Create an emergency fund. Aim for at least 3-6 months’ worth of living expenses.

- Develop a family emergency plan, including evacuation routes and meeting points.

- Assemble an emergency supply kit. This should include water, non-perishable food, a first aid kit, important documents, and other essential items.

Remember, prepping is a journey, not a destination. You don’t have to do everything at once.

What are some innovative insurance solutions that preppers should consider in 2024?

- parametric insurance, which provides immediate payouts based on predefined triggers, like wind speed or earthquake magnitude.

- Crowd-based insurance, where policyholders pool resources to cover losses, reducing the need for large premiums.

- Climate risk modeling, which uses advanced analytics to better understand and price climate-related risks.

- Resilience-based insurance, which incentivizes policyholders to invest in disaster-resistant infrastructure.

These solutions can complement your prepping efforts by providing financial support when you need it most.

How can I prep for a specific disaster, like a hurricane or wildfire?

- Installing hurricane shutters or boarding up windows.

- Securing outdoor furniture and debris that could become projectiles.

- Having a plan for evacuating or sheltering in place.

- Stockpiling supplies, including water, non-perishable food, and medications.

For wildfires, consider:

- Creating defensible space around your home by clearing flammable vegetation.

- Installing fire-resistant roofing and siding.

- Having a plan for evacuating early, as wildfires can move quickly.

- Preparing a ‘go bag’ with important documents, medications, and other essentials.

What role do community ties play in prepping and survival?

- Joining or forming a neighborhood watch group to keep an eye on each other’s homes.

- Participating in community emergency response team (CERT) training to learn disaster response skills.

- Working with neighbors to create a community emergency plan.

- Sharing resources and knowledge with others in your community.

After all, when disaster strikes, we’re all in it together.

How can I prep for long-term power outages, which are becoming more common?

- Investing in a backup generator. Ensure it’s properly installed and maintained to prevent carbon monoxide poisoning.

- Stockpiling non-perishable food and water. Aim for at least a three-day supply.

- Having alternative light sources, like flashlights, lanterns, and solar-powered lights.

- Preparing a ‘cold’ box or cooler to keep perishable food fresh.

- Learning how to manually open garage doors, turn off gas valves, and perform other tasks that usually require electricity.

Also, consider installing a whole-house standby generator, which can provide power to your entire home during an outage.

What should I do if I can’t afford to prep as much as I’d like to?

- Start small. Even a few dollars a week can add up to a significant emergency fund over time.

- Buy supplies in bulk and look for sales. Many prepping items, like canned goods and water, can be stored for years.

- Repurpose items you already have. For example, a camping tent can serve as an emergency shelter.

- Learn new skills, like first aid or gardening, which can enhance your self-sufficiency without costing much.

- Join a community group or co-op to share resources and knowledge with others.

Remember, the goal of prepping is to be self-reliant, not to have the most or newest gear.

How can I prep if I live in an apartment or have limited space?

- Focus on versatile, multi-purpose items. For example, a camping stove can be used for cooking and boiling water.

- Store supplies in clear, labeled containers to maximize space and make it easy to find what you need.

- Use under-bed storage or wall-mounted shelves to make the most of your space.

- Consider a ‘bug-out bag’ for each family member, containing essentials that can be easily grabbed and taken with you if you need to evacuate.

- Learn skills that don’t require much space, like first aid, cooking, or gardening in small containers.

Also, consider building community ties with your neighbors, as they can be a valuable resource in a disaster.

How can I prep for the psychological impact of disasters?

- Educating yourself about common reactions to disasters, like stress, anxiety, and post-traumatic stress disorder (PTSD).

- Developing coping strategies, like deep breathing, meditation, or talking to a mental health professional.

- Building a support network of friends, family, or community members who can provide emotional support after a disaster.

- Creating a family emergency plan that includes communication strategies, like a family meeting place and communication plan.

- Practicing your plan through drills and discussions to help everyone feel more prepared and less anxious.

Also, consider learning about disaster psychology to better understand and prepare for the emotional challenges of disasters.

How can I involve my children in prepping?

- Educate them about common disasters and what to do in an emergency. Use age-appropriate language and resources.

- Involve them in creating an emergency supply kit. Let them help choose and pack items.

- Practice emergency drills, like fire drills or earthquake drills, and make them fun. Turn them into games or competitions.

- Teach them life skills, like first aid, cooking, or gardening, which can enhance their self-sufficiency and resilience.

- Encourage them to ask questions and express their feelings about disasters. This can help them process their emotions and feel more in control.

Remember, the goal is to empower your children, not to scare them.