Buckle up, dear readers, as we dive into an exciting development in the world of insurance and risk management! Verisk, a global data analytics powerhouse, has just submitted its wildfire catastrophe model for review by the California Department of Insurance (CDI). This move comes hot on the heels of new regulatory changes aimed at bringing stability to California’s insurance market, which has been grappling with the escalating risks and costs associated with wildfires. So, grab your virtual marshmallows and let’s gather ’round this metaphorical campfire to explore the fascinating intersection of technology, climate change, and insurance!

Reinsurance News: A Deep Dive into Verisk’s Groundbreaking Initiative

Imagine a vivid, stylized map of California, not just a geographical representation, but a live, breathing illustration of the state’s wildfire dynamics. Across the landscape, wildfire icons blaze, not to signify destruction, but to illuminate the power of data in predicting and mitigating risk. This isn’t your average map; it’s a testament to the intersection of technology and environmental awareness.

Beside this fiery tableau, a sleek graph pulsates with life, its peaks and valleys telling a tale of risk assessment. It’s more than just data visualization; it’s a heart monitor for the state, each fluctuation a testament to Verisk’s commitment to understanding and managing risk. The Verisk logo stands proudly alongside the California Department of Insurance (CDI) seal, a partnership forged in the name of protection and preparedness.

The backdrop of this digital masterpiece is a revolving globe, a constellation of data points and analytical models swirling around it. It’s a stark reminder of the global relevance of climate risk and the technology that empowers us to confront it. This is more than just an image; it’s a call to action, a symbol of California’s relentless spirit in the face of adversity, and a testament to the power of data analytics in shaping a more resilient future.

The Changing Landscape of California’s Insurance Market

In recent years, California’s property insurance market has faced significant challenges due to the increasing risk of wildfires and the escalating costs of claims. With wildfires becoming more frequent and destructive, insurers have had to grapple with unprecedented losses, leading to premium hikes and policy cancellations. This has left many homeowners in wildfire-prone areas scrambling for affordable coverage, creating a crisis in the insurance market.

The California Department of Insurance has stepped in to address this issue by launching a new regulation aimed at expanding insurance access for residents. This regulation, known as the Safer from Wildfires framework, requires insurance companies to take specific steps to ensure that policies are more accessible and affordable for homeowners in high-risk areas. The framework mandates that insurers consider certain factors when underwriting policies, such as:

- The use of wildfire risk reduction measures by property owners

- The investment in community-level fire prevention efforts

- The provision of discounts for properties that have adopted wildfire safety measures

One of the key aspects of the new regulation is the consideration of reinsurance costs. Reinsurance, often referred to as ‘insurance for insurers,’ helps primary insurance companies manage their risk by transferring a portion of it to reinsurers. The regulation acknowledges that reinsurance costs have significantly contributed to the rising premiums for homeowners. To mitigate this, the framework includes provisions that:

- Encourage insurers to diversify their reinsurance portfolios to spread risk more effectively

- Promote the use of innovative reinsurance structures, such as catastrophe bonds, to better manage wildfire risk

- Require insurers to be more transparent about their reinsurance arrangements, ensuring that homeowners understand how these costs are factored into their premiums

Verisk’s Wildfire Catastrophe Model: A Game Changer

In a significant move for natural disaster risk management, Verisk, a leading data analytics provider, has submitted its advanced wildfire catastrophe model for review by the California Department of Insurance (CDI). This submission is not just a formality; it’s a testament to Verisk’s decades of experience and technical prowess in helping insurers, businesses, and governments navigate the complexities of natural disaster risks. With a proven track record in modeling catastrophes like hurricanes, earthquakes, and floods, Verisk is now turning its attention to the growing threat of wildfires.

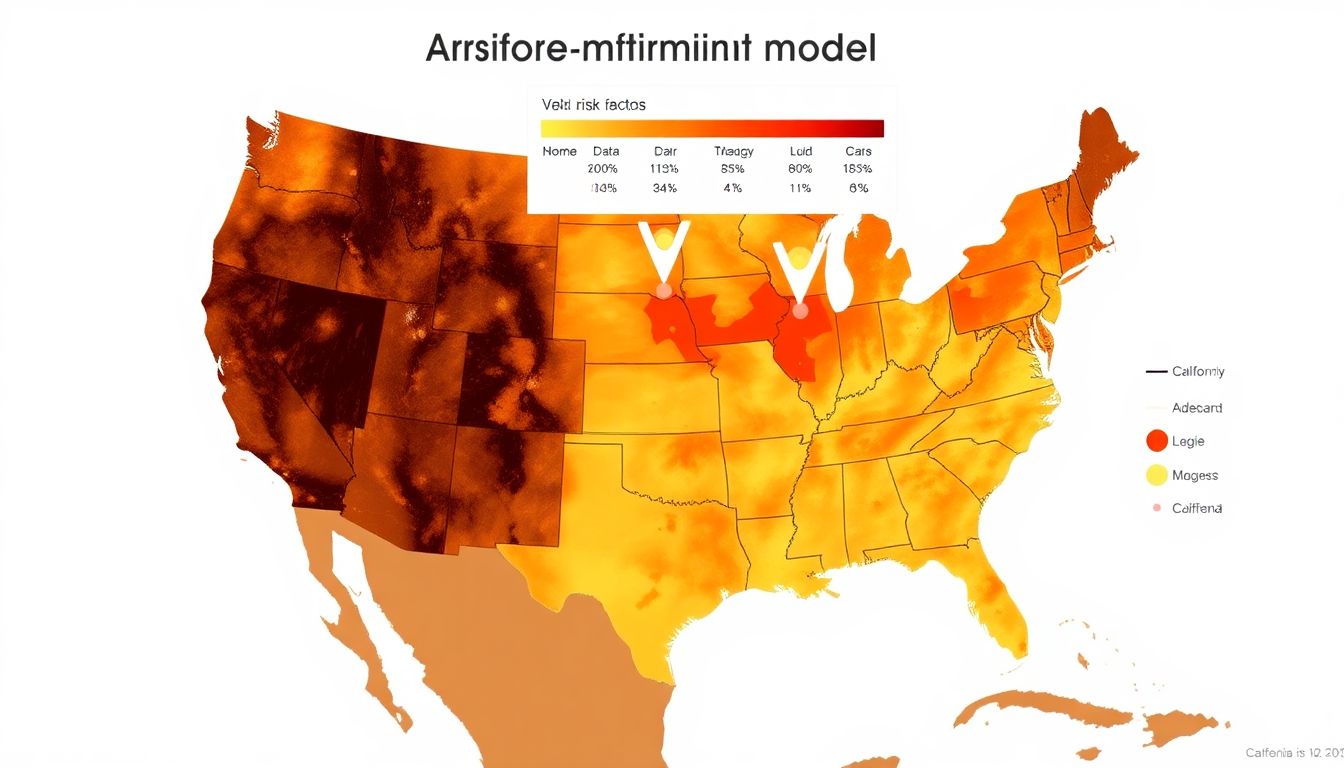

Verisk’s Wildfire Model for the United States is more than just a predictive tool; it’s a comprehensive solution that embodies the company’s deep understanding of wildfire hazards. Developed by a team of experts in atmospheric science, fire ecology, and risk modeling, this innovative model incorporates critical knowledge of wildfire behavior, local weather patterns, terrain, and fuel characteristics. By leveraging advanced technologies and proprietary data, Verisk has created a model that reflects the dynamic and evolving nature of wildfire risks.

The key features of Verisk’s Wildfire Model are impressive:

- High-Resolution Risk Mapping: The model provides detailed, high-resolution maps that identify areas at risk, helping insurers make informed underwriting decisions.

- Probabilistic Modeling: By employing advanced probabilistic methods, the model can simulate millions of potential wildfire scenarios, offering a comprehensive view of potential losses.

- Integration of Recent Trends: The model accounts for recent trends in wildfire activity, including the impact of climate change and urban sprawl, ensuring that it remains relevant and accurate.

- Real-Time Updates: Verisk’s model is designed to incorporate real-time data, allowing for continuous updates and enhanced responsiveness to emerging threats.

Verisk’s submission to the CDI is not just about regulatory compliance; it’s about setting a new standard for wildfire risk management. As wildfires become more frequent and destructive, the need for accurate, reliable modeling has never been greater. With its Wildfire Model, Verisk is demonstrating its commitment to helping communities and businesses better prepare for and mitigate the impacts of these devastating events.

The Role of Catastrophe Models in Insurance Stability

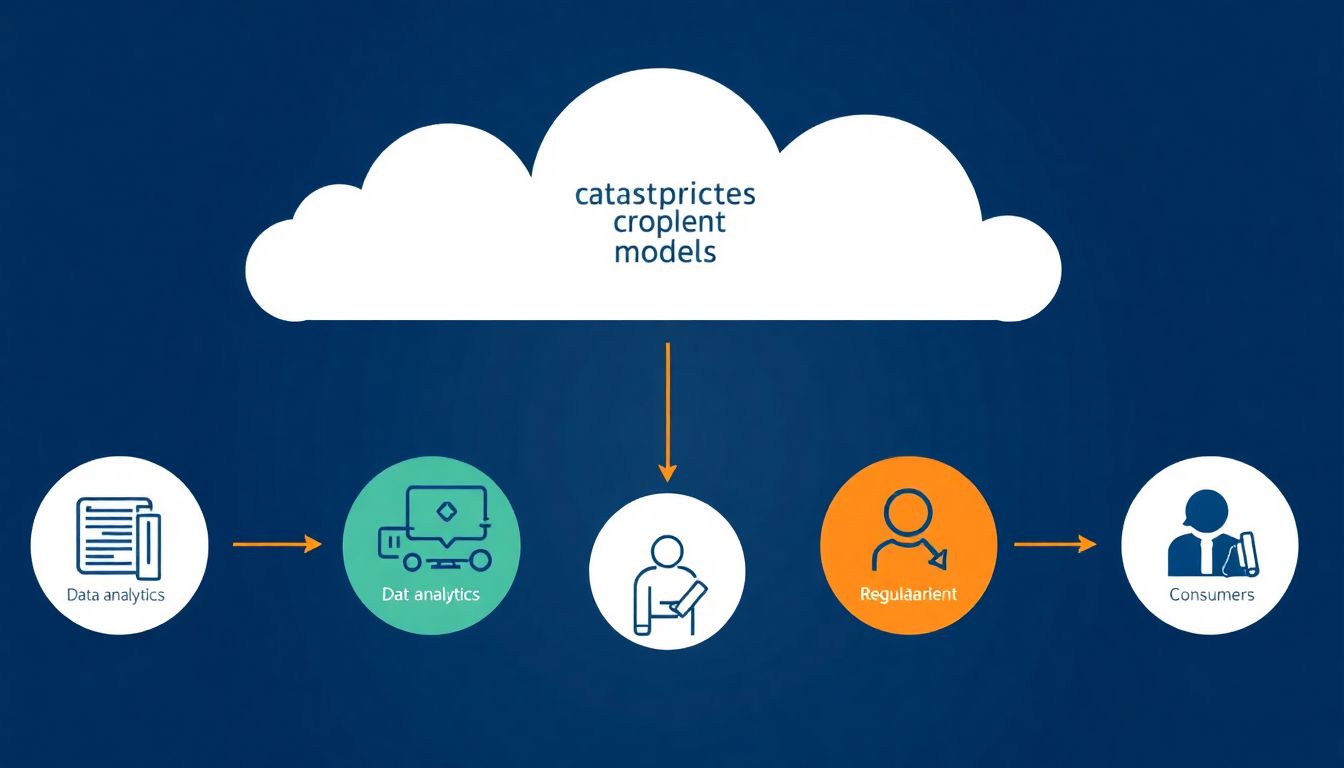

Catastrophe models have revolutionized the way we understand and manage natural disaster risks, proving to be an invaluable tool for insurers, policymakers, and residents alike. By simulating complex events like earthquakes, wildfires, and floods, these models provide enhanced insights into the potential impacts of such disasters, enabling stakeholders to make data-driven decisions. In California, a state particularly prone to a variety of natural hazards, catastrophe models have become instrumental in promoting resilience and mitigating risks.

One of the most significant benefits of catastrophe models is their role in increasing insurance availability across California. By offering a more precise assessment of risks, these models allow insurers to set premiums that accurately reflect the likelihood and severity of potential disasters. This not only helps ensure the financial stability of insurance companies but also makes coverage more accessible and affordable for homeowners and businesses. Moreover, catastrophe models can identify areas where risk is too high for traditional insurance, paving the way for innovative solutions like parametric insurance or public-private partnerships.

Verisk’s recent submission to the California Department of Insurance (CDI) exemplifies the power of effective collaboration between insurers, modeling firms, and regulatory bodies. Verisk, a leading data analytics and risk assessment provider, worked closely with insurers to integrate industry insights and proprietary data into their catastrophe models. This collaboration ensured that the models were not only methodologically sound but also practically relevant, capturing the unique risk landscape of California.

The submission also highlighted Verisk’s engagement with the CDI, demonstrating a public-private partnership that could serve as a blueprint for future collaborations. Through open dialogue and regular consultations, the CDI provided valuable guidance on model parameters and regulatory standards, while Verisk offered technical expertise and industry perspectives. This two-way exchange fostered a mutual understanding of risks and capabilities, ultimately leading to a more robust risk management framework. By fostering such collaborations, catastrophe models can continue to evolve and play a pivotal role in building a more resilient California.

- The models should be approved by the CDI to be used for regulatory purposes

- The CDI does not endorse any particular model or vendor, but reviews models to ensure they meet accepted actuarial standards

- The submission process includes regular updates and revisions to keep up with the evolving understanding of risks and modeling techniques

A New Era of Resilience and Stability

In the dynamic landscape of California’s insurance market, Verisk’s recent submission stands out as a beacon of potential transformation. The submission, a comprehensive collection of risk models and analytical tools, promises to enhance the resilience and stability of both insurance providers and potential insureds. By leveraging advanced data analytics and predictive modeling, Verisk aims to equip insurers with more accurate risk assessments, enabling them to better prepare for and respond to catastrophic events.

One of the most significant impacts of Verisk’s submission is the potential for improved pricing accuracy. With better risk models, insurers can more precisely calculate premiums, ensuring that policyholders are paying rates that truly reflect their risk profiles. This not only helps stabilize the market by reducing the likelihood of sudden rate hikes but also fosters a sense of fairness and transparency among policyholders. Additionally, Verisk’s tools may facilitate more targeted and effective risk mitigation strategies, such as:

- Identifying high-risk areas for proactive intervention

- Developing tailored insurance products for specific market segments

- Enhancing underwriting standards to better account for emerging risks

For potential insureds, Verisk’s submission could mean greater access to affordable and appropriate coverage. With insurers better equipped to understand and manage risks, they may be more willing to offer coverage in previously underserved or high-risk areas. This could help close the insurance gap, providing much-needed financial protection to more individuals and businesses. Furthermore, as Rob Newbold, a prominent industry expert, noted, ‘This is a pivotal moment for the insurance market. With the insights and tools provided by Verisk, we have an opportunity to create a more resilient and inclusive insurance landscape in California.‘

Beyond immediate impacts, Verisk’s submission could also drive long-term stability in California’s insurance market. By promoting more accurate and efficient risk management, the submission could help mitigate the volatility that often follows major disasters. This stability can, in turn, foster a more competitive and innovative insurance market, encouraging more providers to enter the market and offering policyholders a wider range of coverage options. In this way, Verisk’s submission is not just about navigating today’s risks but also about building a stronger, more adaptable insurance market for tomorrow.