Welcome to this fascinating exploration of a significant milestone in the insurance industry! We’ll delve into the groundbreaking submission of the Verisk Wildfire Model for review in California, its implications for the property insurance market, and how this innovative step paves the way for a more resilient future. Buckle up as we journey through the intricacies of catastrophe modeling, regulatory advances, and the quest for sustainable insurance solutions.

Exploring the Impact of Verisk’s Groundbreaking Submission on California’s Property Insurance Landscape

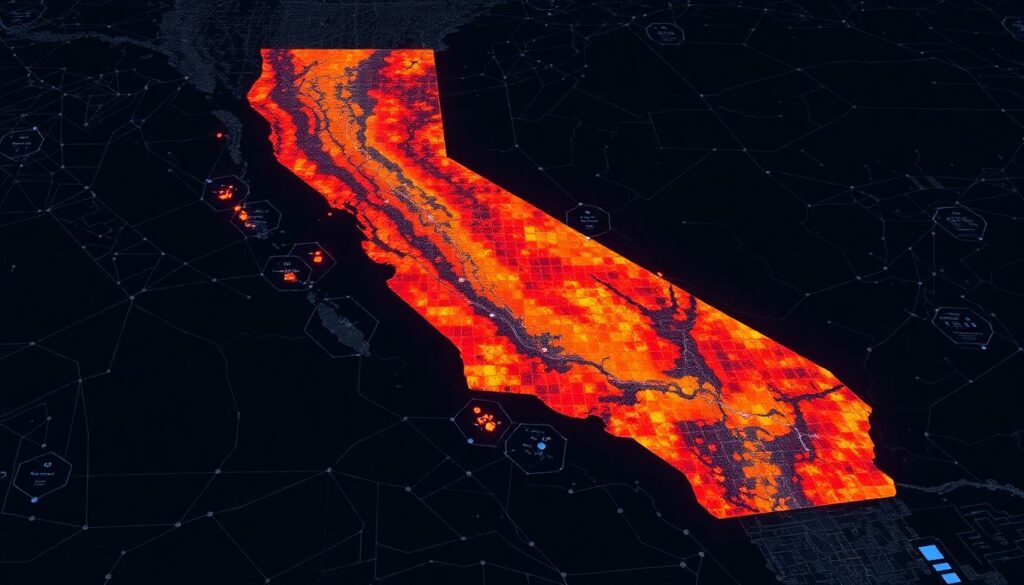

Imagine unfurling a map of California, not as it is today, but as it could be in the not-so-distant future. This is not your ordinary map, it’s a vibrant digital canvas, pulsating with data and insights, a symphony of colors and shapes that tell a story of risk and resilience. Welcome to the future of insurance ratemaking, where advanced technology and data analytics blend seamlessly to create an intricate tapestry of information.

Now, envision wildfire risk assessments overlaid onto this futuristic map. Swirling patterns of red and orange dance across the landscape, not signifying destruction, but preparedness. These are not mere representations of danger, but opportunities for proactive planning and mitigation. With the power of data analytics, we can predict, prepare, and protect, turning potential catastrophes into manageable challenges.

This is the integration of advanced technology in insurance ratemaking. It’s not just about crunching numbers, but about painting a vivid picture of risk and response. It’s about turning data into decisions, algorithms into actions. It’s about protecting lives, properties, and communities in a smarter, more efficient way. This is the future, and it’s a future worth fighting for.

The Dawn of a New Era in Insurance Ratemaking

In a groundbreaking move, Verisk has submitted its advanced wildfire catastrophe model to the California Department of Insurance (CDI), marking a significant step towards enhancing risk assessment and mitigation in the state. This model, designed to predict the potential impact of wildfires with unprecedented accuracy, is expected to revolutionize the way insurers and regulators approach wildfire risk. By leveraging cutting-edge technology and data analytics, Verisk’s model promises to provide a more comprehensive understanding of wildfire behavior, helping to safeguard communities and properties across California.

The submission aligns perfectly with Commissioner Ricardo Lara’s Sustainable Insurance Strategy, which emphasizes the critical role of innovative risk management tools in addressing climate-related challenges. Commissioner Lara has been a vocal advocate for integrating sustainability into insurance practices, recognizing that proactive measures are essential in a state increasingly affected by severe wildfires. Verisk’s model supports this strategy by offering insurers a robust tool to better assess and price risk, ultimately fostering a more resilient and sustainable insurance market.

The potential benefits of this submission are far-reaching, particularly for consumers, insurers, and regulators. Here’s how each group stands to gain:

-

Consumers:

Enhanced risk assessment can lead to more accurate premiums and better coverage options, ensuring that homeowners are adequately protected against wildfire losses.

-

Insurers:

The model provides a detailed risk analysis, enabling insurers to make informed decisions about underwriting and risk management strategies.

-

Regulators:

Access to advanced predictive tools allows regulators to monitor and guide the insurance industry more effectively, promoting stability and fairness in the market.

Moreover, the adoption of Verisk’s wildfire catastrophe model sets a precedent for future innovations in risk assessment. As climate change continues to exacerbate natural disasters, the need for sophisticated predictive tools becomes increasingly urgent. By embracing this technology, California can lead the way in developing resilient strategies that protect both its residents and its vibrant ecosystems. This proactive approach not only addresses immediate risks but also lays the groundwork for a more sustainable and secure future.

Verisk’s Legacy of Innovation in Catastrophe Modeling

Since its inception in 1987, Verisk has been a pioneering force in the realm of catastrophe modeling, revolutionizing the way we understand and mitigate natural disaster risks. Founded by a group of innovative scientists and engineers, Verisk emerged as a response to the growing need for comprehensive risk assessment tools in the insurance industry. The company’s journey began with the development of advanced models for hurricane and earthquake risks, setting a new standard for predictive analytics in the field.

Over the years, Verisk’s expertise has expanded to encompass a wide range of natural hazards, including severe storms, floods, and wildfires. The company’s catastrophe modeling prowess is underpinned by a powerful blend of historical data, advanced analytics, and cutting-edge technology. Verisk’s team of experts—comprising meteorologists, seismologists, geologists, and data scientists—works tirelessly to refine and enhance these models, ensuring they remain at the forefront of risk assessment.

One of the most notable areas where Verisk’s expertise shines is in managing wildfire risks, particularly in California. The state’s unique topography, climate, and population density present a complex challenge for risk management. Verisk’s wildfire models incorporate a multitude of factors, including:

- Fuel types and densities

- Topographical features

- Weather patterns

- Historical fire data

Verisk’s experience and technical prowess have not only helped insurers better understand and price wildfire risk but also aided government agencies and communities in preparing for and mitigating these events. The company’s commitment to continuous innovation and improvement ensures that its models remain a trusted resource for managing natural disaster risks in an ever-changing climate. By providing detailed and actionable insights, Verisk empowers stakeholders to make informed decisions, ultimately enhancing resilience and sustainability in the face of natural catastrophes.

The Verisk Wildfire Model: A Comprehensive Tool for Risk Assessment

The Verisk Wildfire Model for the United States is a cutting-edge tool designed to provide comprehensive insights into wildfire hazards and vulnerabilities. This model isn’t just a static assessment; it’s a dynamic, breathing entity that incorporates the latest knowledge and research in the field. By integrating advanced scientific findings on wildfire behavior, fuel types, and topography, the model offers an unparalleled view of potential wildfire risks across the nation. This includes analyzing how different vegetation types can exacerbate or mitigate fires, and how the landscape’s natural features can influence fire spread and intensity.

One of the standout features of the Verisk Wildfire Model is its detailed consideration of vulnerabilities. The model doesn’t just look at where wildfires might occur; it also examines the potential impact on properties and communities. By incorporating data on local building characteristics, infrastructure, and demographics, the model can estimate the likely losses and damages in specific areas. This granular approach enables more precise risk management strategies, helping communities prepare and respond more effectively to wildfire threats.

The Verisk Wildfire Model stays ahead of the curve by integrating recent trends and variables that are shaping wildfire risk. One of the key factors is climate change, which is altering weather patterns and creating longer, more intense fire seasons. The model takes into account:

- Rising temperatures, which can dry out vegetation and make it more combustible.

- Changing precipitation patterns, which can lead to droughts or increased fuel growth.

- Increased frequency of extreme weather events, such as heatwaves and lightning storms, which can spark wildfires.

Beyond climate, the model also considers the impact of human activities on wildfire risk. This includes factors like land use changes, urban sprawl, and forest management practices. For instance, the expansion of housing developments into wildland-urban interface (WUI) areas can increase the risk of wildfires affecting populated regions. The Verisk Wildfire Model takes these dynamics into account, providing a holistic view of wildfire risk that empowers stakeholders to make informed decisions and take proactive measures to protect lives and property.

Strengthening California’s Insurance Market Through Collaboration

In the face of escalating natural disasters and climate change, the collaboration between insurers, modeling firms, and the California Department of Insurance (CDI) has never been more crucial. This triumvirate can significantly bolster California’s property insurance market by pooling resources, expertise, and data. Insurers bring ground-level insights into policyholder needs and market dynamics, while modeling firms contribute sophisticated risk assessment tools. Meanwhile, the CDI offers regulatory oversight and a profound understanding of the state’s unique insurance landscape. Together, they can tackle challenges such as risk mitigation, accurate pricing, and enhanced consumer protection.

The use of catastrophe models in rate filing can drive several potential outcomes. Firstly, it promotes risk-based pricing, ensuring that policyholders are charged premiums that accurately reflect their risk exposure. Secondly, it encourages proactive risk management by identifying high-risk areas, enabling insurers to set appropriate deductibles and limits. Lastly, it facilitates solvent and competitive markets by helping insurers adequately reserve for future losses and maintain financial stability. To illustrate, consider the following benefits:

- Enhanced accuracy in predicting losses from natural catastrophes

- Improved understanding of risk concentrations and portfolio management

- More reliable data for reinsurance and capital market transactions

However, the efficacy of these outcomes hinges on the integrity of the catastrophe models used. Model integrity validation is not just a regulatory box to check, but a vital process that ensures the models produce reliable and credible results. It involves rigorous testing, peer reviews, and continuous refinement based on real-world data and feedback. The CDI plays a pivotal role in this process by setting stringent standards for model validation and ensuring that insurers and modeling firms adhere to them.

To maintain a robust property insurance market, all stakeholders must work cooperatively and diligently. Insurers should invest in advanced analytics and big data to complement catastrophe models. Modeling firms should commit to transparency and continuous improvement of their models. And the CDI should foster an environment that encourages innovation while protecting consumers. By working in tandem, this alliance can navigate California’s property insurance market through the challenges of climate change and fortify it for the future.

FAQ

What is the significance of Verisk’s submission to the CDI?

How does the Verisk Wildfire Model benefit the insurance industry?

What role does the PRID process play in model integrity?

How does the use of catastrophe models impact California’s property insurance market?

What steps has Verisk taken to ensure the accuracy of its wildfire model?

- Incorporated leading knowledge of wildfire hazards and vulnerabilities.

- Integrated recent trends and variables impacting wildfire risk.

- Leveraged decades of experience and technical expertise in catastrophe modeling.

- Submitted the model for review under the newly established PRID process.