Welcome to this insightful exploration of natural disasters and their impact on business continuity, particularly focusing on the insurance industry’s role in ensuring service continuity. This article will delve into the challenges posed by increasing natural disasters, the importance of robust claims management, and the innovative strategies being employed to mitigate risks and maintain service excellence.

Navigating the Challenges and Innovations in Claims Management

Imagine a landscape ravaged by nature’s fury—trees uprooted, houses mere matchsticks, and streets turned into rivers. The wind’s howl has been replaced by an eerie silence, punctuated only by the distant hum of emergency vehicles. This is the aftermath of a natural disaster, a scene all too familiar in many parts of the world.

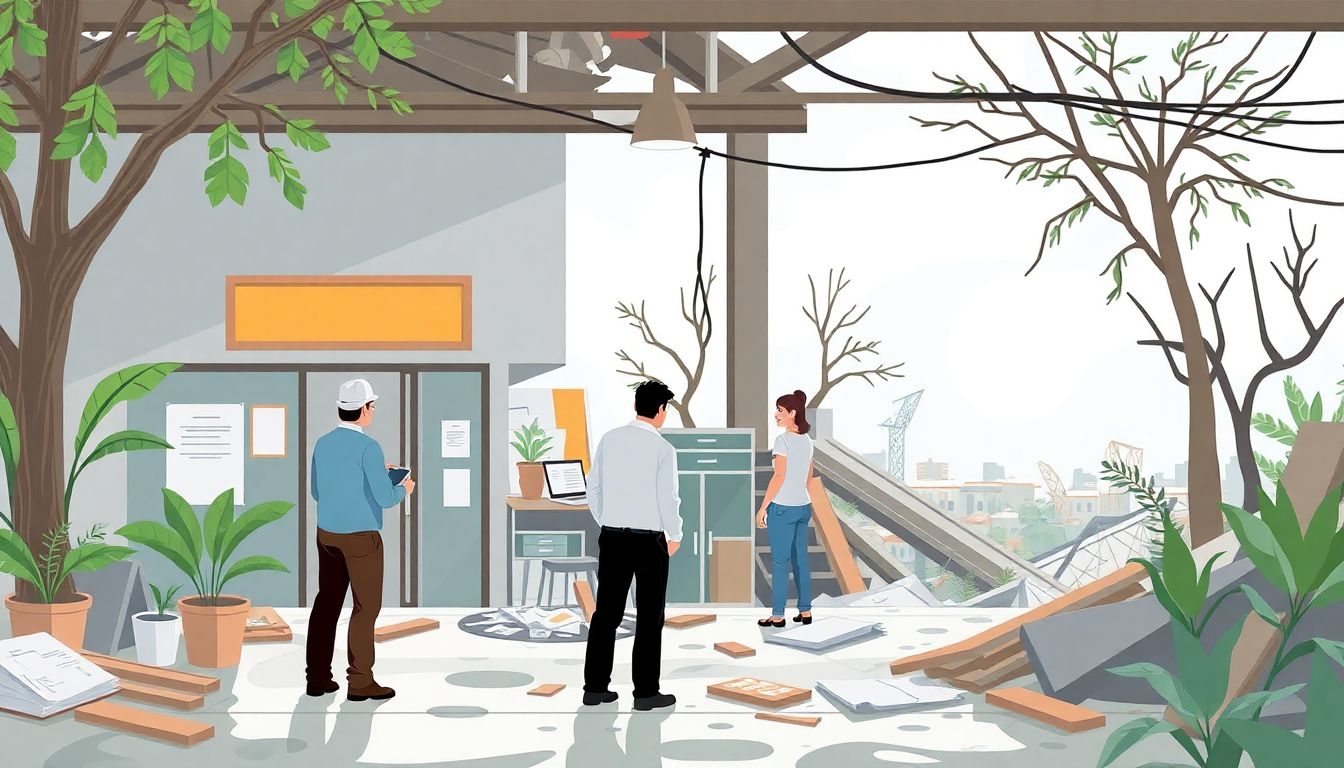

Amidst the chaos, figures in reflective vests and hard hats move purposefully through the scene. These are the insurance adjusters, armed with clipboards and cameras, their eyes scanning the damage with a blend of empathy and professional detachment. They are the unsung heroes of the aftermath, the first steps in rebuilding what was lost.

The importance of their quick and efficient claims management cannot be overstated. For families and businesses alike, the ability to recover and rebuild depends heavily on how soon they can access their insurance benefits. Every moment wasted is a moment stolen from their path to normalcy. This is where the true value of insurance lies—not just in the policy, but in the swift and compassionate response when disaster strikes.

The Rising Tide of Natural Disasters

In recent decades, the world has witnessed an alarming increase in the frequency and severity of natural disasters. According to the Munich Re, one of the world’s leading reinsurers, the number of natural disasters has more than quadrupled in the past 50 years. From 1980 to 2020, the number of reported natural disasters surged from around 400 to over 1,600 per year. Even more concerning is the escalating intensity of these events. The World Weather Attribution initiative has linked many of these extreme weather events to human-induced climate change, highlighting the urgent need for global action.

The link between climate change and natural disasters is becoming increasingly clear. The Intergovernmental Panel on Climate Change (IPCC) reports that global warming is amplifying the intensity and frequency of heatwaves, heavy precipitation events, and droughts. For instance, the IPCC’s Sixth Assessment Report states that heatwaves have become more frequent and severe in most land regions since the 1950s. Furthermore, the National Oceanic and Atmospheric Administration (NOAA) has observed a significant increase in the frequency of heavy downpours in the U.S., with a 30% increase in the Northeast region alone since 1991.

The escalating frequency and severity of natural disasters are placing a significant financial burden on the insurance industry. According to the Swiss Re Institute, insured losses from natural disasters have risen from about $10 billion in the 1980s to over $80 billion in the past decade. In 2021 alone, natural disasters resulted in global insured losses of approximately $120 billion, according to Aon’s Impact Forecasting.

Looking ahead, the outlook appears grim if current trends persist. The Swiss Re Institute predicts that by 2040, global insured losses from natural disasters could reach $235 billion annually, driven primarily by climate change and urbanization. To mitigate these risks, governments, businesses, and individuals must prioritize climate action and invest in resilient infrastructure. Some key strategies include:

- Reducing greenhouse gas emissions to limit global warming.

- Investing in early warning systems and disaster risk management.

- Promoting climate-resilient building practices and infrastructure development.

- Enhancing insurance coverage and risk transfer mechanisms to better protect communities and businesses.

The Role of Insurance in Business Continuity

Natural disasters, from hurricanes and floods to wildfires and earthquakes, pose a significant threat to businesses worldwide. These events can disrupt operations, damage infrastructure, and lead to substantial financial losses. Companies affected by such catastrophes often face a multitude of challenges, including temporary closures, supply chain interruptions, and increased operational costs. The impact is not just financial; natural disasters can also result in data loss, employee displacement, and reputational damage.

The insurance industry plays a critical role in helping businesses manage risks associated with natural disasters. By offering policies that cover property damage, business interruption, and liability, insurers provide a financial safety net that ensures business continuity. In the aftermath of a natural disaster, insurers step in to process claims, assist with repairs, and provide compensation for lost income. This support can mean the difference between a business reopening its doors or shutting down permanently.

However, the insurance industry faces its own set of challenges, particularly when natural disasters strike with increasing frequency and severity. Insurers often grapple with a surge in claims that can strain resources and test operational capacities. Some of the key challenges include:

- Rapid response times to assess damages and process claims efficiently.

- Accurate estimation of losses to ensure fair compensation.

- Prevention of fraudulent claims that can arise during chaotic post-disaster situations.

- Maintaining financial stability despite significant payouts.

To meet these challenges, insurers are investing in technology and data analytics to streamline claims processing and enhance risk assessment. By leveraging tools such as drones for damage assessment, AI for predictive modeling, and digital platforms for customer support, the insurance industry is evolving to better serve policyholders in times of crisis. Ultimately, the resilience of both businesses and insurers hinges on proactive planning, robust risk management, and a commitment to innovation.

Overcoming Claims Management Challenges

In the aftermath of natural disasters, claims management faces several critical hurdles that can significantly impact the recovery process. One of the most pressing challenges is the sheer volume of claims that insurance companies receive in a short span of time. This surge can overwhelm systems and personnel, leading to delays and backlogs. Additionally, the devastation caused by natural disasters often results in infrastructure damage, making it difficult for adjusters to access affected areas and assess damages promptly. This physical barrier can severely impede the claims process, highlighting the importance of having ‘eyes and ears’ on the ground.

The necessity of having local representatives—or ‘eyes and ears’—in disaster-stricken areas cannot be overstated. These individuals provide invaluable real-time insights into the extent of damage and the immediate needs of policyholders. They can also facilitate better communication between insurance companies and affected communities, ensuring that resources are allocated efficiently. Moreover, local representatives can help mitigate fraudulent claims by verifying information and documenting losses accurately. However, deploying these representatives quickly and safely presents its own set of logistical challenges, especially in areas where infrastructure has been severely compromised.

Accurate information is the lifeblood of effective claims management during natural disasters. Unfortunately, the chaos and confusion that follow such events can make gathering precise data a formidable task. Some of the key obstacles include:

- Communication breakdowns due to power outages and damaged telecommunication lines.

- Difficulty in accessing records and documents that may have been destroyed or lost.

- The emotional distress of policyholders, which can sometimes lead to incomplete or inconsistent reporting.

To overcome these hurdles, insurance companies must invest in robust technologies and processes that can ensure data accuracy and reliability even in the most trying circumstances.

Speeding up the settlement process is crucial for helping affected communities rebuild and recover. Several strategies can be employed to expedite claims settlements:

-

Prioritization:

Categorizing claims based on severity and urgency allows for more efficient allocation of resources.

-

Streamlined Workflows:

Simplifying the claims process by reducing bureaucratic steps and leveraging automation can significantly accelerate settlements.

-

Advanced Analytics:

Utilizing data analytics and predictive modeling to anticipate claim volumes and allocate adjusters proactively.

-

Mobile Solutions:

Equipping field adjusters with mobile technologies to enable real-time data collection and processing.

By implementing these strategies, insurance companies can not only expedite the settlement process but also enhance the overall customer experience during a time of great need.

Innovative Solutions for Efficient Claims Management

The insurance industry is no stranger to innovation, and the management of claims during natural disasters is one area where new technologies and practices are making a significant impact. One of the most notable advancements is the use of Artificial Intelligence (AI) and machine learning for claims processing. These technologies can automate the initial assessment of damage, predict the severity of claims, and even identify potential fraud. For instance, Tractable, a company specializing in AI for accident and disaster recovery, has developed AI tools that can analyze photos and videos to assess damage quickly and accurately.

Another innovative practice gaining traction is the use of aerial imagery and geospatial data to expedite claims management. EagleView and Vexcel Imaging are companies that provide high-resolution aerial imagery and analytics to insurance carriers. This data can be used to evaluate property damage and the extent of impacted areas, even when ground access is limited. During the California wildfires, these technologies helped insurance companies assess damage more efficiently, allowing them to process claims faster and help policyholders rebuild their lives.

Moreover, the adoption of Internet of Things (IoT) devices is revolutionizing claims management. Sensors and smart devices can provide real-time data that can be used to monitor properties and mitigate risks. For example, Roost provides smart sensors that can detect water leaks, smoke, and other potential hazards. This information can be used to:

- Alert property owners and insurers to potential issues before they become major problems

- Enable proactive measures to prevent or reduce damage

- Streamline the claims process by providing insurers with detailed, timely data.

Benefits of these innovative technologies and practices include:

- Faster and more accurate claims processing

- Reduced fraud

- Enhanced risk management

- Improved customer service and satisfaction.

FAQ

How does climate change influence the frequency and severity of natural disasters?

What are the main challenges faced by the insurance industry in managing claims during natural disasters?

- Overwhelming volume of claims

- Limited resources and stretched adjusters

- Lack of accurate and timely information

- Difficulty in assessing damage quickly

- Ensuring empathetic and effective communication with affected clients

.

How can technology help in improving claims management during natural disasters?

- Real-time data and satellite imagery for quick assessments

- Drones for surveying large areas efficiently

- Video footage from insured parties for immediate damage reports

- Advanced analytics for predicting and mitigating risks

- Streamlined communication tools for better coordination

.

What steps can businesses take to ensure continuity of service during natural disasters?

- Obtain sufficient insurance coverage

- Develop and implement a comprehensive disaster recovery plan

- Regularly update business interruption figures

- Maintain accurate records of business performance

- Communicate openly with insurers and adjusters

.

How does the insurance industry support communities in rebuilding after natural disasters?

- Providing financial compensation for damages

- Offering empathetic and clear communication

- Deploying resources quickly to affected areas

- Collaborating with local authorities and organizations

- Committing to long-term support throughout the claims process

.