Welcome to this engaging and informative article about the resumption of disaster loans by the U.S. Small Business Administration (SBA). We’ll dive into the details of how this development is bringing relief to small businesses impacted by natural disasters, with a focus on the aftermath of Hurricane Milton in Florida. Let’s explore the stories of resilient business owners and the support they’re receiving to rebuild and thrive.

With the signing of the American Relief Act 2025, the SBA is back in action, providing much-needed financial assistance to businesses affected by recent hurricanes.

Picture this: a quaint, narrow street buzzing with an energy that’s both chaotic and hopeful. Shop owners are sweeping their storefronts, wiping away the last remnants of the storm. The scent of fresh paint and sawdust fills the air, a testament to the ongoing repairs and rebirth. Above the din of hammers and power tools, you hear laughter and friendly chatter, a symphony of resilience.

Smack dab in the middle of it all, there’s a large, hand-painted sign that reads ‘Open for Business,’ a beacon of determination and optimism. It’s propped up against a charming brick building, surrounded by pots of fresh flowers, their vibrant colors a stark contrast to the remnants of the hurricane’s wrath.

Around the sign, there are telltale signs of recovery. New awnings are being installed, windows are being washed, and there’s a general hum of activity. A local café has set up a temporary stand, handing out steaming cups of coffee to weary workers. A bakery next door is already churning out the aroma of fresh bread, drawing in passersby. Children chalk the sidewalks with drawings of rainbows and sunshine, their giggles a melody of hope and renewal.

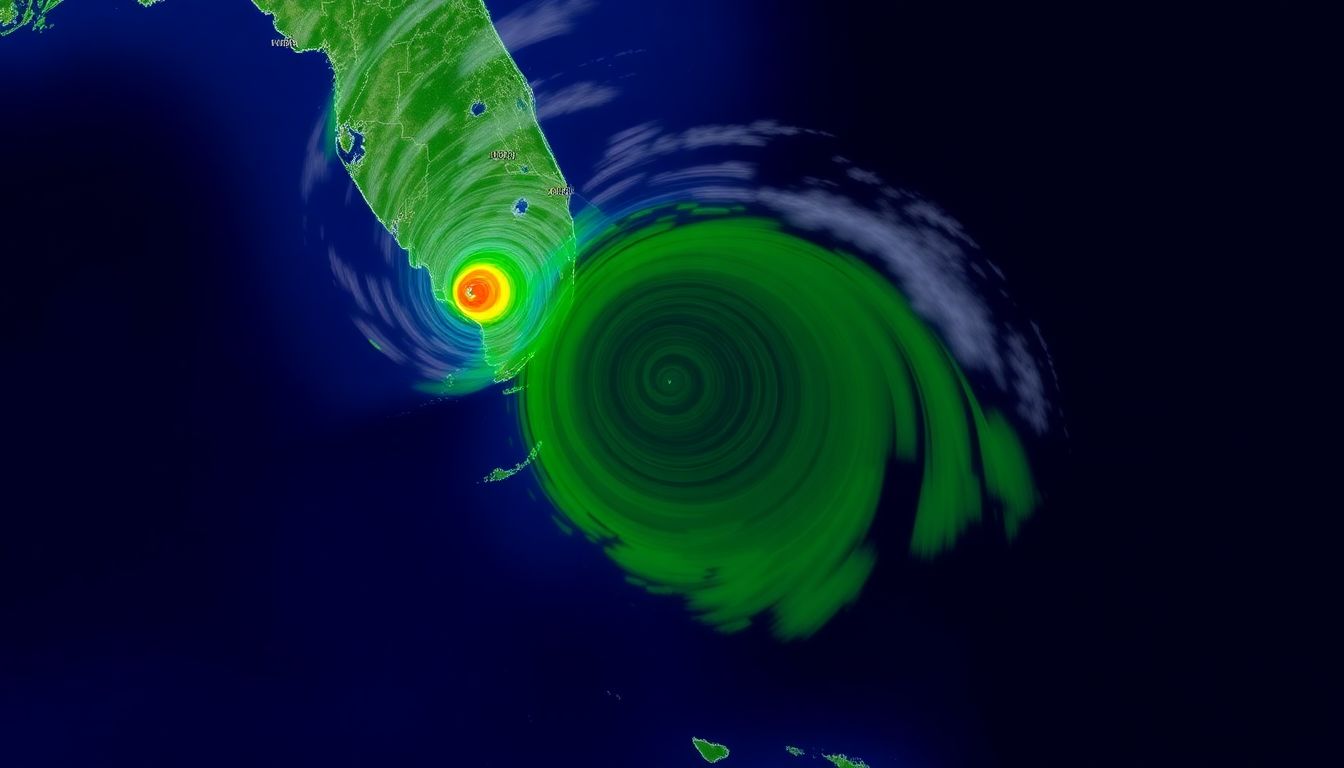

The Impact of Hurricane Milton

In the wake of Hurricane Milton, small businesses in Florida faced catastrophic devastation, with impacts that will ripple through the local economy for years to come. The storm’s ferocious winds and torrential downpours left countless establishments in ruins, forcing entrepreneurs to grapple with the monumental task of rebuilding.

According to a report by McKinsey & Company, the hard numbers paint a stark picture. Nearly 45% of small businesses in the affected areas suffered significant damages, with losses estimated to exceed $250,000 per business. The report also highlights that:

- About 30% of these businesses were forced to close temporarily,

- While another 15% face the grim prospect of permanent closure.

The ripple effects of these closures extend far beyond the immediate business community. Small businesses are the lifeblood of local economies, generating employment opportunities and stimulating growth. McKinsey’s analysis underscores that job losses resulting from Hurricane Milton could surpass 50,000, with the unemployment rate in affected regions potentially increasing by up to 5% in the coming months. This not only disrupts individual livelihoods but also places a significant strain on regional resources and support systems.

Moreover, the road to recovery is fraught with challenges. Small businesses often operate on tight margins, making them particularly vulnerable to disasters. With limited financial reserves, many entrepreneurs find themselves reliant on external aid and insurance payouts. McKinsey’s report warns that insurance claims could take up to a year to process, leaving businesses in a state of prolonged uncertainty. This delay could further exacerbate the economic fallout, as businesses struggle to secure the funds needed to reopen and restore operations.

Funding Resumes: A Beacon of Hope

The American Relief Act of 2025 marked a pivotal moment in the nation’s economic resurgence, offering a lifeline to businesses devastated by unprecedented challenges. This comprehensive legislation, signed into law with bipartisan support, aimed to bolster economic recovery through strategic initiatives. One of the most celebrated aspects of the Act was the resumption of SBA disaster loans, a program designed to provide low-interest loans to businesses affected by disasters, both natural and economic.

The significance of the resumed SBA disaster loans cannot be overstated. These loans, managed by the Small Business Administration (SBA), offered crucial financial assistance for businesses struggling to stay afloat. The loans provided much-needed capital for operational expenses, debt restructuring, and even expansion opportunities. With the American Relief Act, the SBA disaster loan program was revamped to include:

- Streamlined application processes to expedite funding

- Enhanced loan amounts to meet increased financial needs

- Extended repayment terms to ease the burden on borrowers

Business owners like Jennifer Winchester and Susan Chellini found renewed hope through these initiatives. Jennifer, owner of a small boutique in rural Iowa, saw her business grind to a halt during the economic downturn. With the SBA disaster loan, she was able to:

- Restock her inventory with trendy, high-quality products

- Hire additional staff to improve customer service

- Invest in a user-friendly e-commerce platform to reach a wider audience

Jennifer’s story is a testament to the transformative power of these loans.

Similarly, Susan Chellini, who runs a family-owned Italian restaurant in New York, utilized the SBA disaster loan to:

- Upgrade her kitchen equipment to increase efficiency

- Expand her outdoor seating to accommodate more customers

- Launch a successful marketing campaign to attract new patrons

Susan’s restaurant, once on the brink of closure, now thrives as a vibrant community hub. These personal accounts underscore the broader impact of the American Relief Act and the resumption of SBA disaster loans, highlighting how targeted financial support can rejuvenate local economies and foster resilience among small businesses.

The Road to Recovery

Applying for an SBA disaster loan is a streamlined process designed to help businesses and residents recover from declared disasters. The first step is to register with FEMA (Federal Emergency Management Agency). You can do this online at DisasterAssistance.gov or by phone at (800) 621-3362. Once registered, you will receive an FEMA registration number, which you will need to apply for an SBA disaster loan.

After obtaining your FEMA registration number, you can proceed with the SBA loan application. You have the option to apply online using the SBA’s secure website at DisasterLoanAssistance.sba.gov, or you can visit a local Business Recovery Assessment Center. For residents of Hillsborough County, the center is located at:

Hillsborough County Business Recovery Assessment Center

Entrepreneur Collaborative Center

2101 E. Palm Avenue

Tampa, FL 33605

The center operates Monday through Friday from 9:00 AM to 6:00 PM, and Saturday from 9:00 AM to 1:00 PM. During your visit, you will have access to SBA customer service representatives who can assist you with the loan application process.

When applying for an SBA disaster loan, it’s essential to have the necessary documents ready. Here’s a checklist to help you prepare:

- Completed SBA loan application (SBA Form 5 or 5C for businesses)

- IRS Form 4506-T completed, signed and dated

- Tax Information Authorization (IRS Form 8821)

- Complete copies of the most recent Federal Income Tax Return

- Schedule of Liabilities (SBA Form 2202)

- Personal Financial Statement (SBA Form 413)

Gathering these documents beforehand will expedite the application process and ensure a smoother experience at the Business Recovery Assessment Center.

Community Support and Resilience

In the wake of natural disasters, the road to recovery can be long and arduous, but one thing that consistently proves to be a vital lifeline is supporting small businesses. These enterprises are often the backbone of local economies, providing essential goods and services, creating jobs, and contributing to the unique character of their communities. By backing these businesses in the aftermath of disasters, residents can help to restart the economic engine, ensuring that money flows back into the local area, accelerating recovery efforts, and fostering a sense of shared resilience.

Small businesses, in particular, require substantial support post-disaster as they often lack the robust resources and extensive insurance coverage that larger corporations possess. Patronizing local shops, restaurants, and services translates directly into helping neighbors, friends, and family members regain their financial stability. Furthermore, it aids in restoring essential infrastructure, as these businesses pay local taxes and employ local people, creating a positive ripple effect throughout the community.

Community engagement plays an indispensable role in bolstering this economic recovery. Here’s how you can engage and support:

-

Shop Locally:

Make a conscious effort to purchase goods and services from local vendors.

-

Volunteer:

Offer your time and skills to help businesses clean up, rebuild, or operate while they’re short-staffed.

-

Promote:

Share updates and encouragements about your favorite local spots on social media to generate buzz and attract more customers.

-

Provide Feedback:

Let business owners know what you appreciate about their services and what you think could be improved.

By actively participating in these ways, individuals can expedite the healing process of their towns or cities, demonstrating the power of unity and shared purpose.

Moreover, community engagement fosters mental and emotional resilience. Natural disasters can be traumatic, but by collectively focusing on rebuilding and supporting each other, communities can mitigate the emotional toll. Each meal bought from a local eatery, each item purchased from a nearby retailer, and each social media post promoting a neighborhood business adds up, sending a clear message that the community is committed to rising above the devastation and thriving together.

FAQ

Who is eligible to apply for SBA disaster loans?

What types of assistance does the Business Recovery Assessment Center provide?

- Coaching on SBA disaster loan programs

- Business mentoring

- Funding strategies

.

How can I apply for an SBA disaster loan?

What are the operating hours of the Business Recovery Assessment Center?

- Thursday, Dec. 26: 8 a.m. to 4 p.m.

- Friday, Dec. 27: 9 a.m. to 2 p.m.

- Saturday, Dec. 28, and Sunday, Dec. 29: Closed

- Monday, Dec. 30: 9 a.m. – 4 p.m.

- Tuesday, Dec. 31: 9 a.m. – 1 p.m.

- Wednesday, Jan. 1: Closed

- Thursday, Jan. 2: 8 a.m. – 4 p.m.

- Friday, Jan. 3: 8 a.m. – 2 p.m.

- Saturday, Jan. 4, and Sunday, Jan. 5: Closed