As climate change continues to exacerbate natural disasters, one of the most pressing concerns is the increasing frequency and severity of floods. A new study by the Federal Reserve sheds light on a troubling reality: nearly three-quarters of expected flood damage to American homes is currently uninsured. This alarming statistic reveals a significant gap in preparedness, particularly among certain demographic groups. In this article, we delve into the findings of the Federal Reserve’s working paper, exploring the financial risks and the political divide that could turn this environmental challenge into a partisan disaster.

Uninsured and Unprepared: The Hidden Costs of Climate Change

Imagine a once-peaceful suburban neighborhood, now transformed into an eerie lake. Manicured lawns and neatly paved driveways are swallowed by murky floodwater, the result of a relentless downpour that has shown no mercy. The familiar landscape is now a blur of rooftops and submerged mailboxes, a stark reminder of nature’s unpredictable fury.

Now, superimpose a graph onto this watery scene. The graph’s bold lines illustrate the stark disparity in insurance coverage among the residents. The lines peak and dip like the floodwater itself, telling a story of financial preparedness—or lack thereof. Those with comprehensive coverage are likely to weather this storm financially, while others may be left to grapple with the crippling costs of repair and replacement.

To make the scene even more compelling, add icons representing political affiliations, scattered across the partially submerged houses. These icons—little elephants and donkeys—highlight the partisan divide that can often exacerbate such disasters. It’s a poignant reminder that even in the face of nature’s wrath, political divisions can influence who sinks and who swims, both literally and figuratively.

The Scope of the Problem

In the United States, flood damage is an escalating concern, with the National Oceanic and Atmospheric Administration (NOAA) projecting that up to $20 billion in flood losses may occur annually by the end of the century. What’s more alarming is that a significant portion of these losses, up to 60%, is expected to be uninsured, leaving homeowners to grapple with the financial aftermath alone. This stark reality is attributed to the fact that standard homeowners insurance policies do not cover flood damage, and many homeowners are either unaware of this fact or do not appreciate the true risk of flooding to their properties.

The Federal Reserve has been instrumental in quantifying these figures through a comprehensive methodology. By integrating data from the Federal Emergency Management Agency (FEMA)‘s flood maps, property records, and insurance coverage statistics, the Federal Reserve employs sophisticated modeling techniques to estimate the extent of flood damage and the proportion that is uninsured. This approach involves several key steps:

- Overlapping geospatial data from FEMA’s flood maps with property parcels to identify at-risk properties.

- Applying depth-damage curves to estimate the dollar value of damages based on predicted flood depths.

- Surveying insurance coverage in high-risk areas to determine the percentage of properties that lack adequate flood insurance.

The implications for homeowners are severe. Those who find themselves underinsured or uninsured may face financial ruin in the event of a major flood. Recovery can be a daunting task, with out-of-pocket expenses soaring to tens or even hundreds of thousands of dollars. Furthermore, the ripple effects extend beyond individual homeowners, affecting community economies, local infrastructure, and even the broader national economy. With climate change exacerbating the frequency and severity of flood events, the urgency to address this issue has never been greater.

To mitigate these risks, homeowners are encouraged to take proactive steps. This includes:

- Understanding their property’s flood risk and reviewing insurance policies to ensure adequate coverage.

- Considering the purchase of separate flood insurance policies, especially in high-risk areas.

- Implementing flood mitigation measures, such as elevating structures, installing flood barriers, and improving drainage systems.

The Insurance Gap

The insurance gap, a term coined to represent the disparity between the insurance coverage households have and the coverage they actually need, is a growing concern, particularly when it comes to flood damage. But why are so many people underinsured? One of the primary reasons is the perceived unlikeliness of floods. Many homeowners, especially those who do not live in designated flood zones, underestimate the risk of flooding, assuming that it’s a rare occurrence that won’t happen to them.

Another significant contributor to the insurance gap is the cost of flood insurance. Many homeowners find flood insurance to be too expensive. The National Flood Insurance Program (NFIP) estimates that the average annual premium is around $700, but this can vary widely depending on the property’s location and flooding history. As a result, many households at risk of flood damage do not have adequate coverage, with 80 percent being greatly underinsured.

A further complication is the complexity of insurance policies. Navigating the intricacies of insurance coverage can be daunting for homeowners. Policies can be laden with jargon, and understanding what is and isn’t covered can be challenging. Standard homeowners insurance typically does not cover flood damage, a fact that many homeowners are unaware of. This lack of awareness contributes significantly to the insurance gap.

The average shortfall in insurance needed to cover potential damage is a stark reminder of the extent of this issue. According to a survey by InsuranceQuotes, the average shortfall is around $60,000. This means that, in the event of a flood, many homeowners would find themselves significantly out-of-pocket, struggling to cover the costs of repairs and replacements. The reasons for this shortfall are multifold, encompassing all the factors mentioned above. To bridge this gap, it’s crucial to raise awareness about the reality of flood risks, make insurance policies more accessible and affordable, and educate homeowners on the importance of adequate coverage.

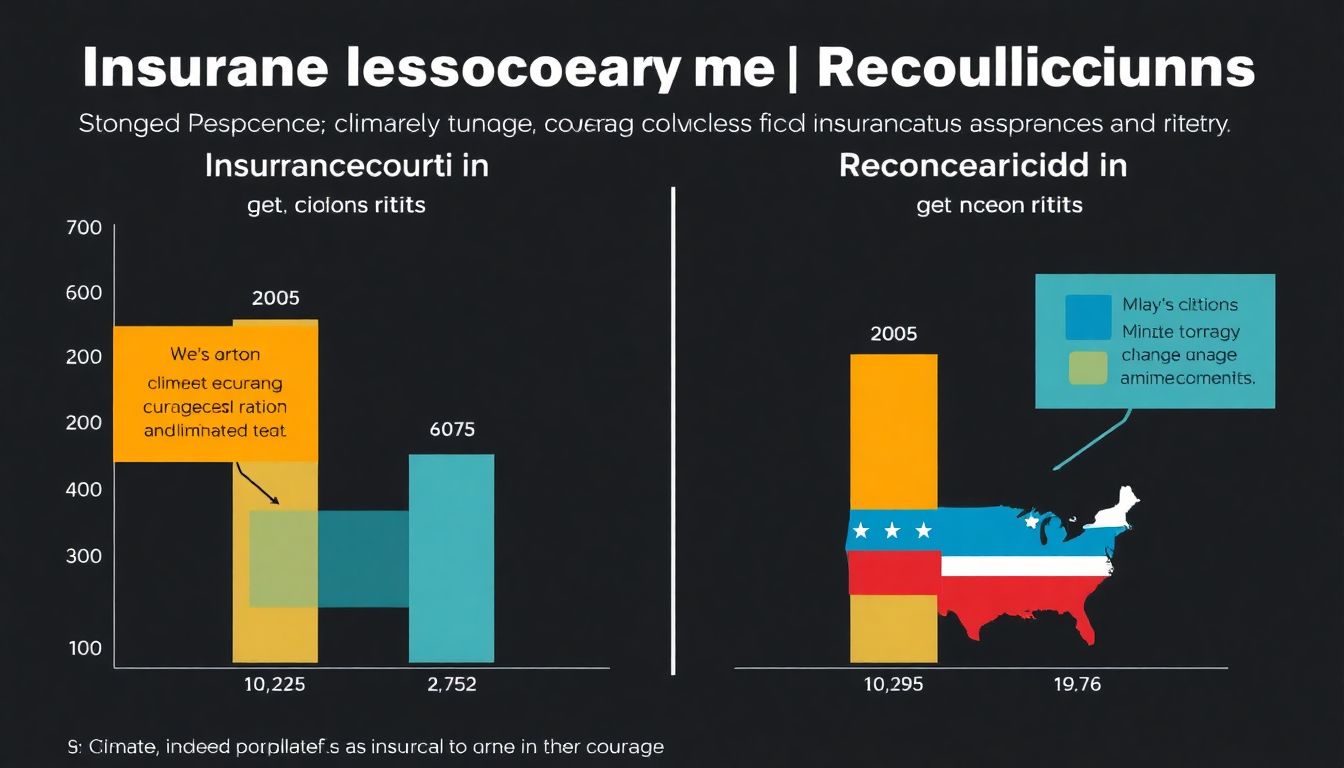

The Partisan Divide

The political dimensions of the climate change and insurance issue are deeply rooted in the ideological divide between Republicans and Democrats. Republicans tend to be more skeptical about the reality and severity of climate change, with many conservatives viewing it as a natural phenomenon rather than a man-made crisis. This skepticism is often intertwined with a belief in limited government intervention, which extends to their views on healthcare and insurance. Those who do not feel personally threatened by climate change are less likely to see the value in comprehensive insurance policies that cover environmental disasters, leading them to opt for cheaper, less comprehensive plans, thereby increasing their chances of being underinsured.

Several factors contribute to the higher likelihood of Republicans and climate change skeptics being among the underinsured:

-

Perception of Risk:

Those who do not believe in or feel immediately threatened by climate change may underestimate the risks of natural disasters, leading them to choose insurance policies with inadequate coverage.

-

Political Ideology:

Republicans often favor market-based solutions and are opposed to government mandates, which can translate to a preference for cheaper, less regulated insurance policies.

-

Information Bubbles:

Individuals may be influenced by media and social circles that downplay the risks of climate change, further reinforcing their decision to forgo comprehensive insurance.

The potential political fallout from this situation is significant. As climate change continues to manifest in more frequent and severe natural disasters, underinsured individuals may find themselves in dire financial straits. This could lead to a political backlash, with constituents blaming their representatives for not doing enough to protect them or educate them about the risks. Policies aimed at mitigating climate change and encouraging adequate insurance coverage could become hot-button issues in election campaigns.

Impact on policy-making could be profound. Lawmakers may be compelled to introduce legislation that mandates better risk education or more comprehensive insurance requirements. However, this could also deepen partisan divides, with Republicans potentially opposing such measures on grounds of personal freedom and market principles. Conversely, Democrats might advocate for stronger regulations and subsidies to ensure all Americans are adequately protected. The debate could shape broader policy discussions around climate change, healthcare, and the role of government in safeguarding citizens’ well-being.

Looking Ahead: Solutions and Preparedness

Bridging the insurance gap and enhancing preparedness for floods requires a multi-faceted approach that combines robust policy frameworks, comprehensive education, and community-driven initiatives. One of the primary solutions is to reform insurance policies to make them more accessible and affordable. Governments can incentivize insurance companies to offer competitive rates and expand coverage options. Additionally, mandatory flood insurance for properties in high-risk areas can ensure that more homeowners are protected against financial losses.

Education plays a pivotal role in mitigating the financial risks associated with flood damage. Implementing public awareness campaigns can educate residents about the importance of flood insurance and the steps they can take to protect their properties. Schools and community centers can host workshops and seminars to teach people about flood preparedness and emergency response strategies. Moreover, digital platforms can be utilized to disseminate real-time flood alerts and safety guidelines, ensuring that everyone is well-informed and prepared.

Community initiatives are equally crucial in bolstering flood preparedness. Establishing local flood action groups can foster collaboration among residents, local authorities, and emergency services. These groups can organize community clean-up efforts, assess local flood risks, and develop emergency response plans. Furthermore, green infrastructure projects, such as planting trees and creating wetlands, can help absorb excess water and reduce the impact of floods.

To further mitigate financial risks, consider the following policy, education, and community initiatives:

- Government subsidies for low-income households to purchase flood insurance.

- Integration of flood risk management into school curricula.

- Partnerships with local businesses to sponsor community flood preparedness events.

- Development of a national flood risk map to inform policy decisions and public awareness.

FAQ

What are the key findings of the Federal Reserve’s working paper?

Why are Republicans and climate change skeptics more likely to be underinsured?

What are the implications of this insurance gap for homeowners?

How can the insurance gap be addressed?

- Increased awareness and education about flood risks and the importance of insurance.

- Policy initiatives to make flood insurance more affordable and accessible.

- Community-based preparedness programs to help residents understand and mitigate flood risks.