Welcome to this insightful exploration of global market dynamics and investment strategies. In this article, we delve into the fascinating world of Matthew McLennan, a renowned money manager at First Eagle Investments. McLennan’s approach to investing is both innovative and cautious, blending the allure of technological advancements with the prudence of traditional hedging strategies. Join us as we uncover the secrets behind his success and the potential risks that nations’ debts pose to global markets.

A deep dive into Matthew McLennan’s investment philosophy and the global fiscal landscape

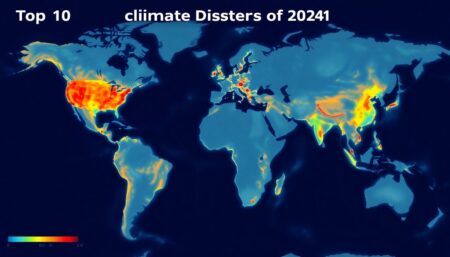

Imagine a vast ocean, teeming with ships of various sizes and colors, each representing a different investment from around the globe. This is the global market, a dynamic and interconnected web of financial opportunities and risks. Like the ocean, the global market can be calm and fruitful one moment, and turbulent and unpredictable the next. Storms can brew unexpectedly, driven by geopolitical tensions, economic policy shifts, or even natural disasters, causing waves of uncertainty that can rock even the sturdiest of investment vessels.

In this ever-changing seascape, savvy investors seek a safe harbor to weather the storms. Gold, with its steady glow, acts as a beacon of stability amidst the tumult. Like an anchor, it provides a stronghold against market volatility, often moving inversely to riskier assets during times of distress. Its intrinsic value, unlinked to any single economy or currency, makes it a reliable hedge against financial uncertainties.

Consider two scenes: one during a bull market, where ships sail smoothly, their sails billowing with confident investments; the other during a downturn, where ships are tossed on rough seas, their captains seeking a glimmer of hope. In both scenarios, gold stands firm, a shining island of refuge. It serves as a tangible asset, a timeless treasure that investors can turn to when other investments lose their luster. In the global market ocean, gold is more than just a precious metal; it’s a symbol of resilience and a hedge against the unknown.

The March of Humankind: A Balancing Act

Matthew McLennan, the esteemed investor and portfolio manager, has a unique fascination that sets him apart in the world of finance: human progress. McLennan is not just an investor; he’s a student of history, a voracious reader, and a keen observer of societal trends. He believes that understanding the arc of human progress is key to identifying investment opportunities. By studying the past, he gains insights into the future, not just in terms of technological advancements, but also in societal shifts and changing consumer behaviors. This perspective allows him to make informed investment decisions that capitalize on long-term trends.

However, McLennan’s approach is not solely focused on growth and progress. He also emphasizes the importance of disaster preparedness. Balancing investment opportunities with disaster preparedness is a critical aspect of his strategy. He believes in hoping for the best but preparing for the worst. This mindset is not just about risk management in the traditional sense; it’s about understanding that progress is not linear. Setbacks, crises, and disasters can and do occur, and being prepared for these events can help mitigate their impact on investments.

So, how does McLennan translate this philosophy into his investment strategy? One of the key aspects is his use of gold as a hedge. Gold has historically served as a safe haven during times of economic uncertainty or crisis. It often appreciates in value during these periods, acting as a buffer against losses in other areas of an investment portfolio. McLennan sees gold as more than just a commodity; it’s a form of insurance against potential disasters.

McLennan’s approach to investing is a nuanced blend of optimism and caution. He believes in the power of human progress to drive growth and create exciting investment opportunities. However, he also understands the importance of being prepared for the unexpected. By using gold as a hedge, he ensures that his investment strategy is balanced and resilient. Here are some key takeaways from his approach:

- Study history to understand future trends.

- Balance growth with preparedness.

- Use gold as a hedge against uncertainty.

Building a Resilient Portfolio

Hamish McLennan’s strategy for building a resilient portfolio is a masterclass in focusing on scarcity value and incumbency advantage. He believes that identifying businesses with unique assets or positions that are difficult to replicate is key to long-term success. By honing in on companies with incumbency advantage, McLennan looks for those that are entrenched in their industries, having built formidable moats that keep competitors at bay. These companies often enjoy steady cash flows and robust balance sheets, allowing them to weather economic storms and maintain dividend payouts.

McLennan’s approach to finding undervalued stocks is truly global, transcending geographical boundaries to uncover hidden gems. He sifts through markets worldwide, zeroing in on companies that are trading below their intrinsic value. His process involves rigorous fundamental analysis, assessing each company’s financial health, management quality, and growth prospects. By adopting a contrarian mindset, McLennan is not afraid to invest in unloved or overlooked stocks, understanding that market sentiment can often lead to mispricing. Some of the key factors he considers include:

- Low price-to-earnings (P/E) ratios

- Strong balance sheets

- Consistent earnings growth

- Underappreciated catalysts for future growth

Gold plays a pivotal role in McLennan’s portfolio, serving as a hedge against market volatility and currency depreciation. He recognizes gold’s scarcity value and its enduring appeal as a safe-haven asset. By allocating a portion of his portfolio to gold, McLennan aims to preserve capital and provide a vital insurance policy against unforeseen economic events. Furthermore, gold’s lack of correlation with other asset classes offers valuable diversification benefits, smoothing out portfolio returns over time.

McLennan’s investment philosophy coalesces around the principles of patience, discipline, and a long-term horizon. He shuns short-term market noise, preferring instead to focus on the underlying fundamentals of his investments. His commitment to thorough research, global diversification, and a balanced approach to risk management has consistently yielded impressive results, making him a respected figure in the investment community.

Preparing for 2025: A Global Outlook

In his latest economic forecasts, McLennan presents a compelling vision for 2025, zeroing in on key areas that will significantly impact the global economic landscape. Let’s kickstart with the U.S. stock market, where McLennan anticipates a shift from the once-dominant technology sector to a more diversified market. He predicts a boom in infrastructure and green energy stocks, fueled by the administration’s commitment to sustainable initiatives. This shift isn’t just about profits; it’s about paving the way for a more resilient and eco-friendly economy.

McLennan’s gaze also extends to the global stage, where inflation remains a hot topic. He foresees a world where central banks have finally tamed the inflation beast, with rates hovering around the 2% mark. However, this doesn’t mean it’s all smooth sailing. Emerging markets, grappling with higher U.S. interest rates and a stronger dollar, may face increased financial volatility. McLennan advises investors to keep an eye on these markets, as they could present both opportunities and pitfalls.

Now, let’s turn our attention to the East, where China’s economic policies are set to make waves. McLennan predicts that China’s shift towards a consumer-driven economy and its focus on technological self-sufficiency will have ripple effects worldwide. He highlights the following potential impacts:

- Increased competition in the tech sector, as Chinese firms become more prominent global players.

- A boost in commodity prices, driven by China’s domestic demand.

- A shift in trade dynamics, as other economies adjust to China’s changing import and export patterns.

Lastly, McLennan emphasizes the critical role of fiscal discipline in ensuring economic stability. He warns against the risks associated with sovereign debt, cautioning that high debt levels could limit governments’ ability to respond to economic shocks. McLennan advises policymakers to prioritize debt reduction and implement structural reforms to promote long-term growth. He also urges investors to pay close attention to countries’ fiscal health, as this could significantly influence global markets in the years to come.

Favorite Stocks: Oracle and Meta Platforms

Matthew McLennan, the esteemed Head of the Global Value Team at First Eagle Investment Management, has recently expressed his enthusiasm for two tech giants: Oracle and Meta Platforms. These companies, while distinct in their offerings, share a common thread of dominance in their respective markets and a promising outlook for the future.

Let’s first consider Oracle, a multinational computer technology corporation known for its enterprise software products and services. Oracle’s market position is robust, thanks to its comprehensive suite of cloud applications, platform services, and engineered systems. The company is making significant strides in adapting to contemporary trends, particularly in cloud computing. Oracle’s aggressive push towards cloud infrastructure and its autonomous database offering are positioning it as a formidable competitor to the likes of Amazon Web Services and Microsoft Azure. With a strong balance sheet and a history of generous dividends, Oracle’s future prospects look promising. Its strategic acquisitions and commitment to research and development are expected to drive long-term growth, making it a favorite among investors like McLennan.

Now, turning our attention to Meta Platforms, formerly known as Facebook, this social media behemoth has carved out an enviable market position. With a family of apps that includes Instagram, WhatsApp, and Facebook itself, Meta’s reach is truly global. However, the company is not resting on its laurels. It is actively adapting to challenges such as regulatory scrutiny, privacy concerns, and the ever-evolving digital landscape. Meta’s future prospects are tied to its ability to innovate and pivot. The company is investing heavily in the metaverse, a collective virtual shared space created by the convergence of physically persistent virtual worlds, augmented reality, and the internet. This bet on the future of digital interaction could potentially open up new revenue streams and solidify Meta’s position as a pioneer in this emerging field.

Both Oracle and Meta Platforms are exemplary in their approach to navigating contemporary trends and challenges. Here’s how they are adapting:

-

Innovation:

Both companies are investing heavily in research and development to stay ahead of the curve.

-

Strategic Acquisitions:

They are not shy about acquiring other companies to enhance their offerings and expand their reach.

-

Pivoting:

Whether it’s Oracle’s shift to cloud computing or Meta’s bet on the metaverse, both companies are adept at pivoting their strategies to capitalize on new opportunities.

-

Addressing Challenges:

From regulatory scrutiny to privacy concerns, these companies are proactive in addressing challenges that come their way.