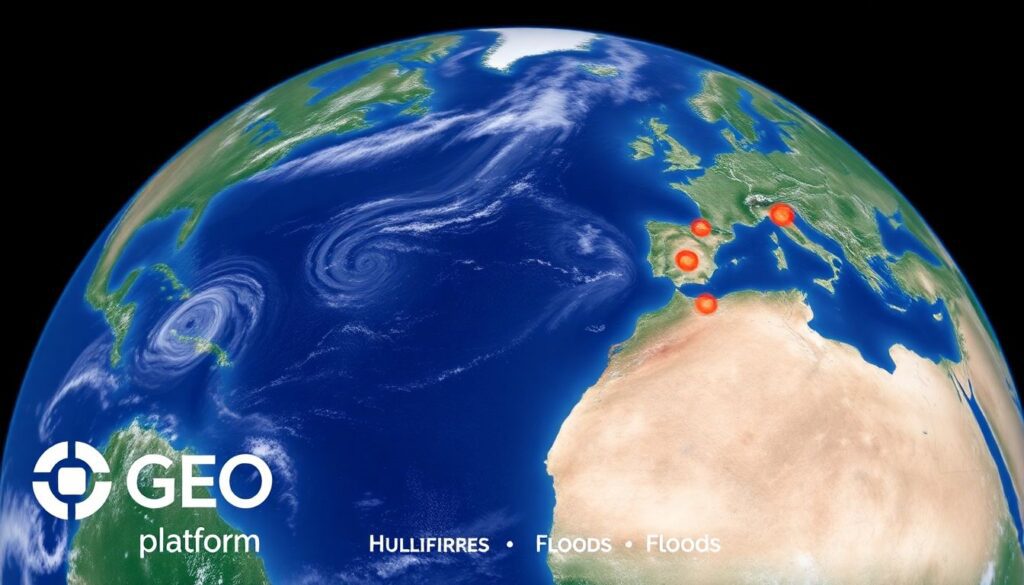

In the dynamic landscape of the insurance industry, one name has been making waves with its innovative use of geospatial intelligence: McKenzie Intelligence Services (MIS). Today, we’re thrilled to announce that MIS has reached a significant milestone with its Global Events Observer (GEO) platform, amassing an impressive 200 global catastrophic event reports. But what does this mean for the insurance sector, and how can understanding this achievement help you navigate the complex world of catastrophic event response management? Let’s dive in.

Have you ever wondered how insurance companies stay ahead of the curve when it comes to natural disasters, political unrest, or other catastrophic events? The answer lies in the power of geospatial intelligence, and MIS is at the forefront of this revolution. With its GEO platform, MIS is transforming the way insurers prepare for, respond to, and recover from catastrophic events, making it a game-changer in the industry.

Imagine this: you’re an insurance professional tasked with managing a global portfolio. A catastrophic event occurs halfway across the world, and you need real-time, accurate data to assess the impact on your policyholders and make critical decisions. How do you ensure you’re getting the most up-to-date, reliable information? This is where MIS’s 200 global catastrophic event reports come into play. These reports, generated by the GEO platform, provide insurers with the vital intelligence they need to make informed decisions, mitigate risks, and ultimately, protect their clients.

So, what can you, as a prepping enthusiast or a professional in the insurance industry, gain from this article? By the end of this piece, you’ll have a comprehensive understanding of how MIS’s GEO platform is revolutionizing catastrophic event response management. We’ll delve into the power of geospatial intelligence in insurance, explore the significance of MIS’s 200 global catastrophic event reports, and provide you with practical insights on how to prep and respond to similar situations. Whether you’re an insurance professional looking to stay ahead of the curve or a prepper eager to learn from the best, this article promises to equip you with the knowledge you need to navigate the unpredictable world of catastrophic events. So, buckle up and get ready to explore the fascinating intersection of technology, intelligence, and insurance.

McKenzie Intelligence Services’ GEO Platform: A Beacon of Resilience in the Face of Global Catastrophes

McKenzie Intelligence Services’ GEO Platform: A Beacon of Resilience in the Face of Global Catastrophes

The Rise of Catastrophic Events: A Global Concern

In recent years, the world has witnessed an alarming increase in the frequency and severity of both natural and human-made disasters. From devastating hurricanes and wildfires to cyberattacks and pandemics, these catastrophic events have caused unprecedented damage, disrupting lives, economies, and ecosystems on a global scale.

The reasons behind this trend are multifaceted. Climate change, fueled by human activities, is exacerbating the intensity and unpredictability of natural disasters. Meanwhile, technological advancements have led to the creation of sophisticated weapons and cyber tools that can cause widespread destruction in the wrong hands. Additionally, urbanization and population growth have increased the number of people and infrastructure exposed to these threats.

In response to this growing concern, there is an urgent need for advanced tools and systems that can help manage and mitigate these catastrophic events. One such tool is the Global Earth Observation System of Systems (GEOSS), also known as the Global Earth Observing System (GEO). GEO is a unique and innovative initiative that aims to provide a comprehensive and coordinated approach to global Earth observations.

GEO enables the sharing of data and information among participating countries, international organizations, and other stakeholders. This collaborative effort allows for a more accurate and timely understanding of environmental changes and hazards, enhancing our ability to prepare for, respond to, and recover from disasters. By leveraging the power of GEO and other advanced tools, we can strive to minimize the impact of catastrophic events and build a more resilient future.

Introducing McKenzie Intelligence Services and the GEO Platform

Introducing McKenzie Intelligence Services and the GEO Platform

GEO: A Game Changer in Catastrophe Response Management

GEO: A Game Changer in Catastrophe Response Management

From Hurricanes to Earthquakes: GEO’s Global Impact

From Hurricanes to Earthquakes: GEO’s Global Impact

GEO’s Unmatched Capabilities: AI and Military Intelligence Expertise

GEO’s Unmatched Capabilities: AI and Military Intelligence Expertise

The Future of Catastrophe Management: Enhancing GEO’s Capabilities

The Future of Catastrophe Management: Enhancing GEO’s Capabilities

Preparing for the Inevitable: How Insurers Can Leverage GEO

Preparing for the Inevitable: How Insurers Can Leverage GEO

FAQ

What is McKenzie Intelligence Services and how does it contribute to the insurance industry?

How does the Global Events Observer (GEO) platform facilitate catastrophic event response management?

What are some of the catastrophic events that MIS has reported on through its GEO platform?

How does geospatial intelligence help in post-event assessment and recovery?

What are the benefits of integrating geospatial intelligence into insurance underwriting processes?

How does McKenzie Intelligence Services ensure the accuracy and reliability of its geospatial data?

What role does McKenzie Intelligence Services play in enhancing insurance industry resilience to catastrophic events?

How can insurers best leverage McKenzie Intelligence Services’ offerings to prepare for and respond to catastrophic events?

- Integrate MIS’s GEO platform into their existing risk management systems for real-time event monitoring and early warning capabilities.

- Leverage MIS’s geospatial intelligence for underwriting and portfolio management to better assess and price risks.

- Establish clear protocols for responding to MIS’s event alerts and reports, ensuring swift and effective action when catastrophic events occur.

- Collaborate with MIS to develop customized solutions tailored to the insurer’s specific needs and risk profile.

- Regularly review and update response plans based on insights gained from MIS’s geospatial intelligence to ensure ongoing preparedness.