Have you ever wondered how a country’s currency can impact your daily life? In Bangladesh, the recent depreciation of its currency, the Taka, has sent ripples through the economy, affecting everything from the price of daily necessities to the country’s trade dependencies. But what does this mean for the value of the Indian Rupee in Bangladesh, and how can you, as a resident or a frequent visitor, prepare for such situations? Let’s dive into the world of currency exchange rates and explore how you can navigate the challenges posed by Bangladesh’s currency depreciation.

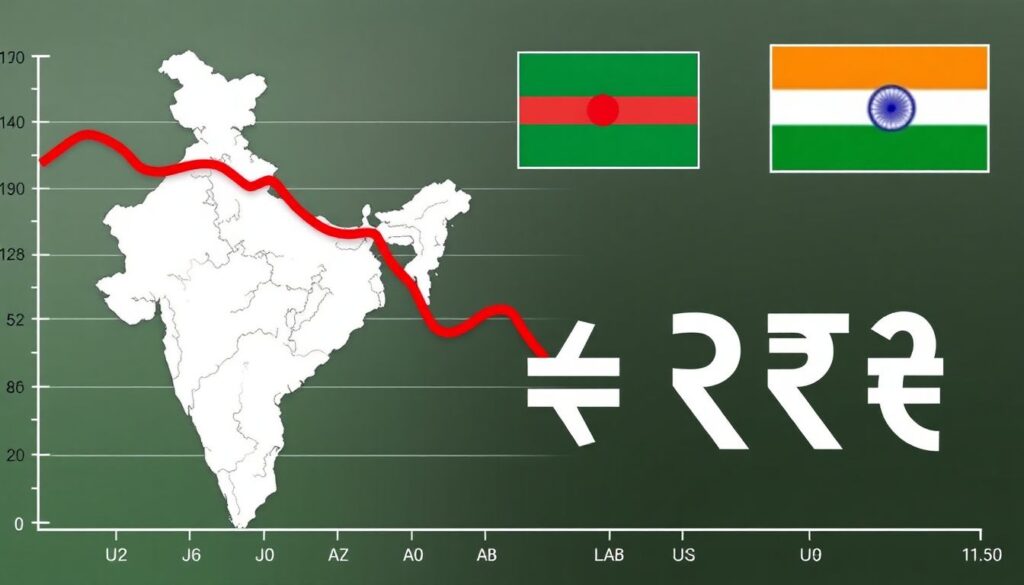

First, let’s address the elephant in the room. The Bangladesh currency, the Taka, has been on a downward spiral, losing value against major currencies like the US Dollar and the Indian Rupee. As of late, the Indian Rupee has been trading at around 2.40 Taka, a significant shift from its previous value. But why is this happening, and what does it mean for Bangladesh and its citizens?

Bangladesh, with its robust textile industry and growing economy, is heavily dependent on international trade. The country imports a significant amount of its goods, including raw materials and consumer items, from India. The depreciation of the Taka against the Indian Rupee has made these imports more expensive, leading to a potential increase in prices for consumers. This, in turn, can lead to inflation and a decrease in purchasing power for Bangladeshis.

But here’s where you come in. As a resident or a frequent visitor, you don’t have to be a victim of these economic fluctuations. You can prepare, or ‘prep’, for such situations by understanding the current exchange rates, diversifying your income and expenses, and even investing wisely. This article aims to equip you with the knowledge and tools necessary to navigate the challenges posed by Bangladesh’s currency depreciation.

So, are you ready to take control of your financial future? Let’s start by understanding the current value of the Indian Rupee in Bangladesh and explore how you can use this information to your advantage. Stay tuned!

Navigating Economic Storms: Understanding the Indian Rupee’s Rise in Bangladesh

In the dynamic world of international finance, the Indian Rupee’s recent surge in Bangladesh has sparked both curiosity and concern among the populace. The Rupee, once a humble currency, has been making waves, appreciating against the Bangladesh Taka, the country’s official currency. This shift, while presenting opportunities, also poses challenges that every individual and family should be prepared to navigate.

To understand this economic phenomenon, one must delve into the intricacies of international trade and currency exchange rates. The Rupee’s rise can be attributed to a multitude of factors, including India’s robust economic growth, increased foreign investment, and improved trade balances. This appreciation has significant implications for Bangladesh, a country that shares a substantial trade relationship with India. The rise in the value of the Rupee makes Indian goods more expensive in Bangladesh, potentially impacting import-dependent sectors and consumer prices.

However, this economic storm also presents opportunities for preppers and astute individuals. Those who have been diversifying their investment portfolios, including investments in Indian markets or Rupee-denominated assets, may find themselves in a favorable position. Moreover, businesses that have been proactive in hedging their currency risks through forward contracts or options may find themselves better equipped to weather this storm.

Preparing for such economic shifts involves a proactive approach. It’s crucial to stay informed about global economic trends and their potential impacts on your personal finances and business operations. Diversifying your investment portfolio, maintaining an emergency fund in local currency, and hedging currency risks are all strategies that can help you navigate economic storms. By being proactive and informed, you can turn potential challenges into opportunities, ensuring your financial resilience in the face of economic uncertainty.

Understanding the Currency Fluctuations

The recent depreciation of the Bangladeshi Taka against the Indian Rupee has been a topic of interest, especially for those engaged in cross-border trade and travel. Let’s break down this complex economic phenomenon into simpler terms.

The Bangladeshi Taka and Indian Rupee have a long history of exchange rate fluctuations, with the Taka typically being weaker. However, the recent depreciation has been quite significant. To understand this, we need to look at the historical context and the factors contributing to this change.

Historically, the Taka has been influenced by various factors, including inflation rates, interest rates, and economic growth in both Bangladesh and India. The Taka has also been affected by global factors such as commodity prices and international financial markets. The COVID-19 pandemic, for instance, has had a significant impact on the Taka’s value due to reduced remittances and decreased export earnings.

Now, let’s look at a brief timeline of the Taka’s value from December 7, 2021, to the present. On December 7, 2021, the exchange rate was approximately Tk 87.50 to 1 INR. As of today, the exchange rate has depreciated to around Tk 92.50 to 1 INR. This means that the Taka has lost value against the Rupee, making imports from India more expensive and exports to India cheaper.

Factors contributing to this depreciation include:

- Higher inflation rates in Bangladesh compared to India.

- Increased demand for the Indian Rupee due to higher gold imports and increased trade with India.

- Reduced supply of the Bangladeshi Taka in the market due to lower exports and remittances.

Understanding these factors can help individuals and businesses prepare for future currency fluctuations and make informed decisions about their financial activities.

The Impact on Daily Life and Trade

The depreciation of the Bangladeshi Taka, the country’s official currency, is not merely a financial phenomenon; it ripples through the daily lives of Bangladeshis, reshaping their purchasing power, influencing local businesses, and altering trade dynamics, both domestically and with neighboring India.

The most immediate impact is felt at the consumer level. A weaker Taka means that imports, which account for a significant portion of goods in Bangladesh, become more expensive. This includes everyday items like food, clothing, and electronics. Consequently, consumer prices rise, squeezing the budgets of ordinary Bangladeshis. For instance, a family that previously spent 10,000 Taka on groceries might now have to shell out 12,000 Taka, a 20% increase that could strain their finances.

Local businesses, especially those involved in retail and distribution, are also affected. They have to absorb the increased costs of imports or pass them on to consumers, risking a drop in sales due to higher prices. This can lead to a vicious cycle of reduced consumer spending, decreased business profits, and potential job losses.

Exporters, however, find themselves in a more favorable position. A weaker Taka makes their products cheaper in international markets, potentially boosting exports. This can stimulate economic growth and create jobs. For example, Bangladesh’s readymade garment industry, a significant contributor to the economy, could see an increase in orders due to the Taka’s depreciation.

The impact on trade with India is also noteworthy. India is Bangladesh’s largest trading partner, and the depreciation of the Taka can influence the balance of trade. Indian goods become more expensive for Bangladeshis, which could lead to a decrease in imports from India. Conversely, Bangladeshi goods become cheaper for Indians, which could potentially increase exports to India. However, this also exposes Bangladeshi businesses to increased competition from Indian companies, which may take advantage of the favorable exchange rate to increase their market share in Bangladesh.

In conclusion, the depreciation of the Bangladeshi Taka is a complex issue that touches various aspects of life and trade in Bangladesh. It underscores the importance of economic stability and the need for policies that balance the interests of consumers, businesses, and the country as a whole.

Bangladesh’s Shift in Trade Dependencies

Bangladesh, a nation known for its vibrant textile industry and rapid economic growth, has traditionally been heavily reliant on India for its imports. This dependency, while beneficial in many ways, has also posed risks, prompting Bangladesh to diversify its trade relations. The shift is a strategic move to ensure economic stability and resilience.

The products that Bangladesh has traditionally sourced from India are diverse, ranging from raw materials like cotton and jute to finished goods such as pharmaceuticals, automobiles, and consumer goods. However, in recent years, Bangladesh has been actively exploring new sources for these products.

One of the most significant shifts is seen in the textile sector. Bangladesh, the world’s second-largest garment exporter, is now sourcing more of its cotton from countries like the United States, Brazil, and Australia. This move not only reduces dependency on India but also ensures a steady supply of high-quality cotton.

Similarly, Bangladesh is looking beyond India for its pharmaceutical needs. It is now importing drugs and medical equipment from countries like China, Germany, and the United States. This shift is crucial given the global health crisis and the need for a steady supply of medical supplies.

The shift in trade dependencies presents both challenges and opportunities. On one hand, it exposes Bangladesh to new markets, reducing the risk of supply disruptions. On the other hand, it requires careful navigation of new trade regulations and geopolitical dynamics. Moreover, building new supply chains can be time-consuming and costly.

Despite these challenges, the opportunities are significant. Diversifying trade relations can lead to increased competition, driving down prices and improving the quality of imports. It also opens up new avenues for exports, as Bangladesh can leverage its new trade partners to access global markets. Furthermore, it strengthens Bangladesh’s negotiating power, allowing it to secure better terms in trade agreements.

In conclusion, Bangladesh’s shift in trade dependencies is a strategic move that reflects the country’s commitment to economic resilience and sustainable growth. While the journey is fraught with challenges, the opportunities it presents are immense. By carefully navigating this shift, Bangladesh can secure a more stable and prosperous future.

Preparing for Economic Uncertainties

In the dynamic economic landscape of Bangladesh, it’s crucial to be proactive and resilient. The current climate, marked by global economic fluctuations and local market shifts, calls for a proactive approach to financial management. Let’s explore some practical tips to navigate these uncertainties and ensure your financial well-being.

The first line of defense is to protect your savings. Diversify your investment portfolio to spread risk. Consider low-risk, high-yield options like fixed deposits, bonds, or mutual funds. Remember, the goal is not to chase high returns but to preserve your capital.

Managing expenses is another critical aspect. Start by creating a budget, tracking your income and expenditure. Identify non-essential expenses and cut back where possible. This could be as simple as cooking at home instead of eating out, or canceling subscriptions you don’t use.

Financial literacy is key in uncertain times. Educate yourself about financial markets, investment options, and economic trends. This knowledge will empower you to make informed decisions. It’s also a good time to review your insurance policies. Ensure you’re adequately covered against potential losses.

Emergency preparedness is not just about having an emergency fund, but also about having a plan. This could include having a ‘go bag’ ready with essential documents, cash, and a change of clothes. It’s also a good idea to have a backup power source and water supply at home.

Lastly, consider how you can profit from the situation. This could be as simple as starting a side hustle, or as complex as investing in a new business venture. The key is to stay flexible and adaptable.

In conclusion, preparing for economic uncertainties is not about predicting the future, but about being ready for it. It’s about turning challenges into opportunities and ensuring that you and your family are financially resilient.

The Role of the Central Bank and Government

The Role of the Central Bank and Government in Economic Crisis Management: A Case Study of Bangladesh

Looking Ahead: Scenarios and Predictions

Present different scenarios for the future of the Bangladeshi Taka and the economy. Discuss the potential impacts of political tensions, global economic trends, and policy changes on the currency’s value. Provide expert opinions and predictions.

Prepping for Similar Situations: Lessons from Other Countries

Prepping for Similar Situations: Lessons from Other Countries

FAQ

What’s the current exchange rate between the Bangladesh Taka (BDT) and the Indian Rupee (INR)?

Why has the Bangladesh currency depreciated recently?

How does Bangladesh’s trade dependency on India affect its currency?

What can Bangladesh do to stabilize its currency?

- increasing exports to boost foreign exchange reserves,

- reducing imports to decrease the trade deficit,

- attracting foreign direct investment,

- managing inflation,

- and implementing policies to encourage the use of local currency in international trade.

How can individuals in Bangladesh prepare for currency depreciation?

- diversifying their savings into different currencies,

- investing in assets that can hold their value during inflation, such as gold or real estate,

- paying off debts to reduce their financial burden,

- and maintaining an emergency fund in local currency to cover immediate expenses.

They can also consider learning about personal finance and economic trends to make informed decisions.

What are some common misconceptions about currency depreciation?

How does currency depreciation affect the cost of living in Bangladesh?

What role do foreign exchange reserves play in currency stability?

How can businesses in Bangladesh adapt to currency depreciation?

- diversifying their supply chain to reduce dependence on imports,

- hedging their foreign exchange risk through financial instruments,

- investing in research and development to innovate and create new products,

- and exploring export opportunities to take advantage of the cheaper local currency.

They can also consider adjusting their pricing strategy to reflect the change in exchange rates.

What can individuals in Bangladesh do to protect their savings from currency depreciation?

- investing in assets that are less sensitive to currency fluctuations, such as real estate or gold,

- diversifying their investment portfolio to include international assets,

- and maintaining an emergency fund in local currency to cover immediate expenses.

They can also consider learning about personal finance and economic trends to make informed decisions about their savings.