Have you ever wondered what it would take for your community to bounce back from a catastrophic event? The recent passage of a bill by Congressman Daniel Webster has sparked hope among communities nationwide, offering a beacon of resilience in the face of natural disasters. But what does this bill entail, and more importantly, what can you do to prepare your community and family for such challenges?

In this comprehensive guide, we delve into the details of the newly passed bill, its potential impact, and the crucial role of prepping in ensuring your community’s survival and swift recovery. We promise to equip you with practical tips, inspiring stories, and expert insights to help you navigate the unpredictable and prepare for the unexpected.

First, let’s agree on one thing: disasters, whether they’re hurricanes, wildfires, or pandemics, are an unfortunate reality. According to the National Oceanic and Atmospheric Administration, the U.S. has experienced 219 weather and climate disasters since 1980, with losses exceeding $1 billion each. These events have left countless communities reeling, highlighting the importance of prepping and community resilience.

Now, let’s explore the Webster bill and its potential impact. The ‘Strengthening the Nation’s Emergency Response to Disasters Act’ aims to enhance federal coordination, improve communication, and bolster community preparedness. By streamlining disaster response and recovery efforts, this bill could significantly reduce the time it takes for affected communities to get back on their feet.

But what does this mean for you and your community? While the bill is a significant step forward, it’s crucial to remember that the most effective disaster response begins at the local level. That’s where prepping comes in. By taking proactive measures to prepare your community and family, you can minimize the impact of disasters and ensure a smoother recovery.

In the following sections, we’ll explore the key aspects of prepping, from building an emergency kit to fostering a culture of preparedness within your community. We’ll also share real-life examples of communities that have bounced back from disasters, highlighting the power of prepping and community spirit.

So, are you ready to take the first step towards making your community more resilient? Let’s dive in and discover how you can help turn the promise of the Webster bill into a reality for your community.

Webster’s Victory: House Passes FEMA Loan Interest Relief Act for Disaster-Affected Communities

In a resounding display of bipartisan support, the House of Representatives has passed the FEMA Loan Interest Relief Act, a bill championed by Representative Daniel Webster. This legislation aims to provide much-needed financial relief to communities devastated by natural disasters.

The FEMA Loan Interest Relief Act seeks to temporarily suspend interest and penalty charges on Small Business Administration (SBA) disaster loans. These loans, typically issued to help businesses and homeowners recover from disasters, can often become a financial burden in and of themselves, as affected individuals and communities struggle to rebuild and restore their livelihoods.

Representative Webster, a long-time advocate for disaster relief and prepping, has been instrumental in pushing this bill forward. He understands that disasters can strike at any time, and that prepping for such events includes not just stockpiling supplies, but also advocating for policies that can help communities bounce back from the financial fallout of these catastrophic events.

This victory in the House is a significant step towards providing real, tangible relief to disaster-affected communities. It serves as a reminder that prepping is not just about individual preparedness, but also about advocating for policies that can help our communities become more resilient in the face of disasters.

The Financial Burden of Natural Disasters

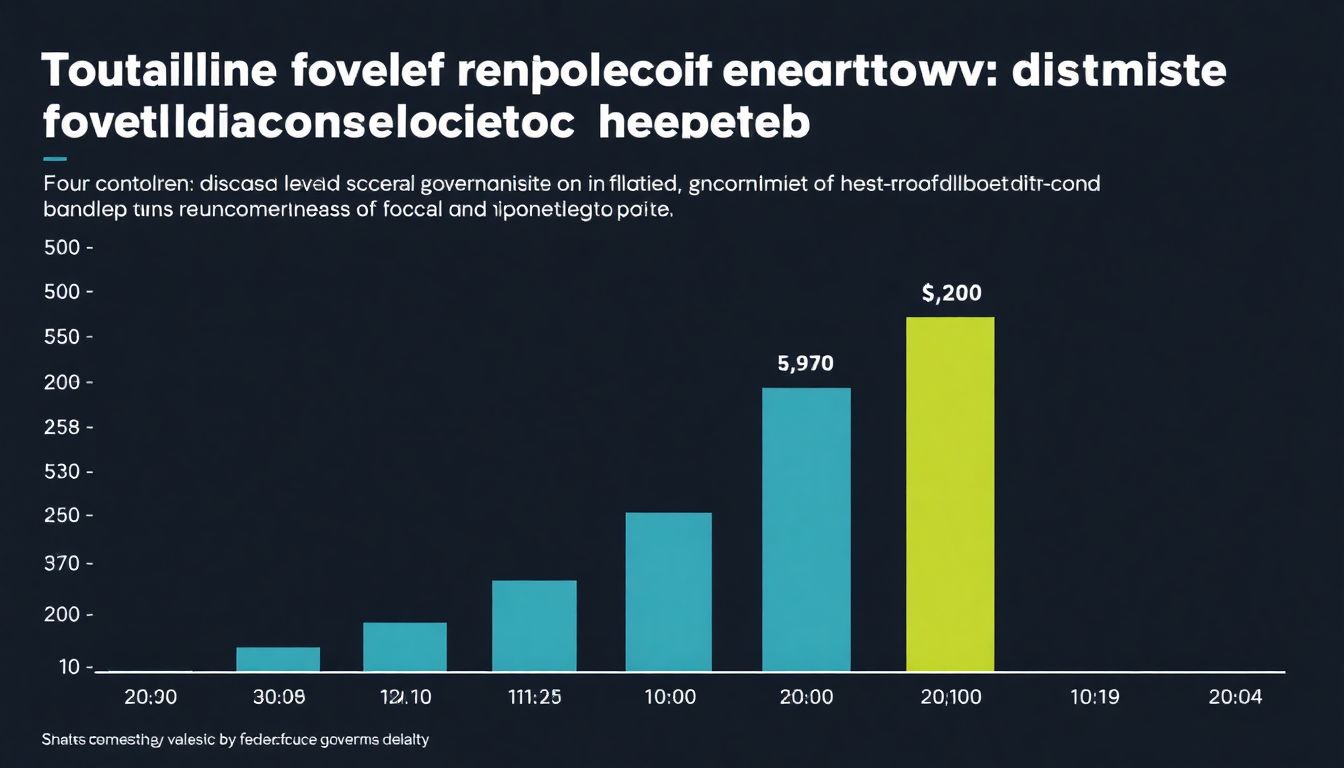

Natural disasters, with their devastating force and unpredictability, leave behind not just physical destruction, but also a significant financial burden that local governments and electric cooperatives must bear. Even with federal aid, these entities often find themselves grappling with substantial financial strain, as the reimbursement process can be lengthy and complex.

The financial burden can be immense. For instance, after Hurricane Sandy in 2012, New Jersey’s costs for recovery and rebuilding topped $30 billion, with the federal government reimbursing only a portion of these expenses. Similarly, following Hurricane Maria in Puerto Rico, the electric cooperative PREPA faced billions of dollars in damages, with federal aid taking months to arrive.

The delay in federal reimbursement can significantly hamper the recovery process. According to a report by the Government Accountability Office, it can take up to two years for local governments to receive full reimbursement from the Federal Emergency Management Agency (FEMA). This delay can tie up local funds, preventing them from addressing immediate needs and starting the rebuilding process. Moreover, it can lead to increased borrowing costs, as local governments may need to take out loans to cover immediate expenses.

To mitigate these financial burdens, local governments and electric cooperatives can take several steps. These include:

- Building up emergency reserves to provide an initial financial cushion after a disaster.

- Pursuing insurance coverage for potential damages, although this can be costly and may not cover all expenses.

- Lobbying for changes in federal policy to expedite the reimbursement process and increase the percentage of costs covered by federal aid.

- Developing strong partnerships with neighboring communities and states to share resources and costs during recovery efforts.

While these steps can help alleviate the financial burden, they do not eliminate the need for federal aid. Therefore, it is crucial for local governments and electric cooperatives to continue advocating for fair and timely federal reimbursement to ensure they can effectively rebuild and recover after natural disasters.

Webster’s Initiative: The FEMA Loan Interest Payment Relief Act

Webster’s Initiative: The FEMA Loan Interest Payment Relief Act

How the Act Provides Financial Relief

How the FEMA Loan Interest Payment Relief Act Provides Financial Relief

Preparing for the Unexpected: Prepping Tips for Communities

Preparing for the Unexpected: Prepping Tips for Communities

The Role of Electric Cooperatives in Disaster Recovery

The Role of Electric Cooperatives in Disaster Recovery

Looking Ahead: The Future of Disaster Relief

The FEMA Loan Interest Payment Relief Act, enacted in response to the COVID-19 pandemic, has provided a lifeline to countless individuals and businesses affected by disasters. This act, which suspends interest payments on certain federal loans, has demonstrated the potential of targeted financial relief in mitigating the long-term impacts of disasters. However, as we look ahead, it’s crucial to consider the potential long-term effects of this act and how it might shape future disaster relief policies.

The act’s most immediate impact has been to alleviate some of the financial burden on disaster victims, allowing them to focus on recovery rather than immediate debt repayment. This has not only provided immediate relief but also set a precedent for future disaster relief policies. It has shown that suspending interest payments can be an effective way to support disaster victims, especially in the critical early stages of recovery.

However, the act’s scope is currently limited to specific federal loans. As we consider the future of disaster relief, it’s worth exploring the possibility of expanding this act’s scope to include other types of disaster-related expenses and loans. This could include private loans, mortgages, and even utility bills, which can often become overwhelming for disaster victims.

Expanding the act’s scope could provide more comprehensive relief to disaster victims. It could also send a clear signal to financial institutions that the government is committed to supporting disaster victims, potentially encouraging these institutions to offer their own forms of relief. Furthermore, it could help to prevent a cycle of debt that often traps disaster victims, making it harder for them to recover and rebuild.

To achieve this, several steps could be taken:

- Congress could amend the act to include a broader range of loans and expenses.

- FEMA could work with state and local governments to identify additional types of relief that could be provided.

- Non-profit organizations and advocacy groups could push for expanded relief, ensuring that the voices of disaster victims are heard in policy debates.

By taking these steps, we can work towards a more comprehensive and effective disaster relief system, one that not only responds to immediate needs but also looks ahead to the long-term challenges faced by disaster victims.