Welcome to our in-depth exploration of the 2024 catastrophic losses driven by flooding, as detailed in the CRESTA report. This article will delve into the significant impacts of natural catastrophes on the insurance industry, highlighting the unprecedented role of flooding in 2024. Join us as we uncover the key events, their financial repercussions, and the future prospects for the insurance sector.

A Year Dominated by Flooding: Insights from the CRESTA Report

Imagine a vivid global map, rendered in stark relief, that tells the story of 2024’s most devastating flooding events. This isn’t your average atlas—it’s a stark visual testament to the power of nature and the urgency of climate change. From the lush landscapes of Southeast Asia to the urban jungles of South America, icons are scattered across the map, each a sobering reminder of the catastrophes that have unfolded.

Picture vivid blue droplet symbols cascading across the map, each one representing a deluge that has left an indelible mark on the communities it touched. In Bangladesh, the icon sits atop the Ganges River Basin, highlighting the monsoon rains that have inundated vast swathes of land, displacing millions. Meanwhile, in the heart of the Amazon rainforest, another droplet icon signals the unprecedented flooding that has transformed low-lying forests into vast, watery expanses.

But the map doesn’t just tell a story of far-off lands; it brings the reality of flooding close to home. In the United States, icons dot the coastlines and riverbanks, from the saturated streets of Miami to the overflowing Mississippi River. Each symbol serves as a grim reminder of the flooding events that have become all too common in a world grappling with rising sea levels and extreme weather patterns. As you zoom out, the map paints a stark picture of a world united by water—not in the idyllic sense, but in the shared struggle against the relentless force of flooding.

The Year of the Floods

In 2024, the insurance industry is grappling with the profound impacts of flooding, a stark shift from the severe convective storms that dominated in 2023. The industry has witnessed a significant surge in total losses, with flooding events costing insurers billions of dollars worldwide. According to recent reports, the global insurance industry is bracing for an estimated $50 billion in payouts, making flooding one of the most costly natural disasters of the year.

The shift from severe convective storms to flooding is not merely a coincidence but a clear indication of the evolving nature of climate change. Scientists have long warned about the increasing frequency and intensity of extreme weather events, and 2024 is proving to be a pivotal year in this regard. Rising temperatures are leading to more moisture in the atmosphere, resulting in heavier rainfalls and more frequent flooding.

The insurance industry is feeling the heat of this climatic shift in several ways:

- Increased Claims: The frequency and severity of flooding events have led to a surge in insurance claims, putting a strain on resources and reserves.

- Premium Hikes: To offset the rising costs, insurers are compelled to increase premiums, making insurance less affordable for many policyholders.

- Risk Reassessment: Insurers are reassessing risk models to better predict and prepare for future flooding events, which may lead to changes in policy terms and coverage.

Climate change is undeniably playing a pivotal role in this shift. Warmer oceans and altered weather patterns are creating more favorable conditions for flooding. Additionally, urbanization and land use changes are exacerbating the impact of floods, as concrete and asphalt surfaces prevent water from being absorbed into the ground. The insurance industry, along with governments and communities, must prioritize mitigation and adaptation strategies to build resilience against these evolving risks.

Major International Catastrophes

The world has witnessed a series of international catastrophes that have resulted in insured losses exceeding $1 billion. These events, characterized by their devastating impacts, have left indelible marks on the affected regions. One such event is the 2011 Tohoku earthquake and tsunami in Japan. Occurring on March 11, 2011, this catastrophe claimed thousands of lives and caused widespread destruction, with insured losses estimated at over $35 billion. The tsunami waves reached heights of up to 40 meters, inundating coastal areas and triggering the Fukushima Daiichi nuclear disaster.

Another significant event is the 2005 Hurricane Katrina in the United States. Striking the Gulf Coast in August 2005, Katrina caused insured losses of approximately $62 billion. The hurricane led to severe flooding, particularly in New Orleans, resulting in over 1,800 deaths and massive property damage. The 2012 Hurricane Sandy, which affected the eastern United States, also exceeded the $1 billion threshold, with insured losses reaching around $30 billion. Sandy caused widespread power outages, flooding, and significant infrastructure damage.

Europe has also experienced catastrophic events, such as the 2002 European floods. These floods, which occurred in August 2002, primarily affected Germany, Austria, and the Czech Republic, with insured losses exceeding $16 billion. The floods resulted in numerous fatalities and extensive property damage. Additionally, the 1999 Odisha cyclone in India caused insured losses of about $4.5 billion. This cyclone, which made landfall in October 1999, was one of the deadliest in Indian history, with over 10,000 deaths and widespread destruction.

Other notable events include the 2010 Chile earthquake, which occurred in February 2010 and resulted in insured losses of around $8 billion. The earthquake triggered a tsunami that caused significant damage along the Chilean coast. The 2008 Sichuan earthquake in China, occurring in May 2008, led to insured losses of approximately $20 billion. This earthquake was one of the deadliest in Chinese history, with over 69,000 deaths and massive infrastructure damage. Two events that narrowly missed the $1 billion threshold are the 2004 Indian Ocean earthquake and tsunami and the 2015 Nepal earthquake. The 2004 tsunami, which affected multiple countries, caused insured losses of around $900 million, while the 2015 Nepal earthquake resulted in insured losses of approximately $800 million.

Spotlight on the Valencia Floods

In the heart of Spain, the historic city of Valencia bore witness to an unprecedented natural catastrophe in 2023. The Valencia Floods, deemed the largest non-US event of the year, left an indelible mark on the region, submerging streets, displacing residents, and leaving a trail of destruction in their wake. The floods were the result of a relentless deluge that overwhelmed the city’s infrastructure, pushing the Júcar River to its breaking point. The torrential rains, which were exacerbated by climate change and unusual weather patterns, highlighted the urgent need for enhanced flood defenses and urban planning.

The significance of the Valencia Floods extended far beyond the immediate devastation, sending ripples through Spain’s insurance market. With thousands of claims pouring in, insurance companies were met with a stark reality check about their exposure to flood risks. The event underscored the critical need for robust risk assessment and innovative insurance products that could adequately cover such large-scale natural disasters. For many insurers, the floods served as a wake-up call, prompting them to reevaluate their policies and consider new strategies to mitigate future risks.

Enter the ‘Consorcio de Compensación de Seguros’ (CCS), a pivotal player in the aftermath of the Valencia Floods. The CCS, a public entity, steps in when private insurers cannot or will not cover certain risks, ensuring that victims of extraordinary events like the Valencia Floods are not left high and dry. The CCS played a crucial role in:

- Managing and settling claims that fell outside the purview of traditional insurance policies.

- Providing financial relief to affected residents and businesses.

- Collaborating with local authorities to expedite the recovery process.

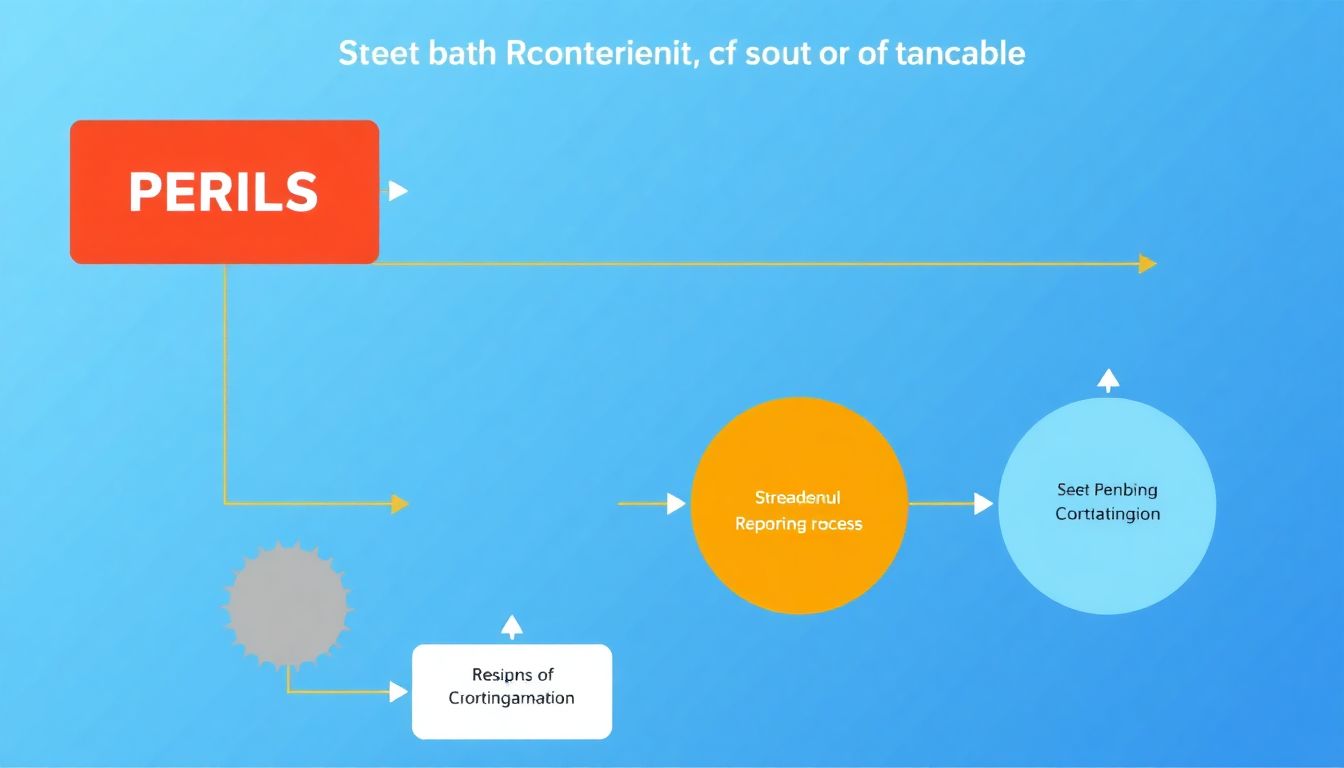

Integration into PERILS and Future Prospects

The integration of CRESTA CLIX into PERILS AG, now rebranded as ‘PERILS EXTENDED‘, marks a significant milestone in the insurance and reinsurance sectors. This merger combines the catastrophe risk expertise of PERILS with the detailed geographic risk data of CRESTA, creating a powerhouse of risk assessment capabilities. “The combination of PERILS’ industry loss data and CRESTA’s geographical risk insights will provide an unparalleled view of global catastrophe risks,” said Luzi Hitz, CEO of PERILS. This integration aims to enhance the industry’s ability to manage and mitigate risks more effectively.

The benefits of this merger are multifold for both insurance and reinsurance sectors. Firstly, it enables a more comprehensive and granular view of risks, allowing insurers to price policies more accurately and reinsurers to manage their exposures more effectively. Secondly, it promotes a standardized approach to risk assessment, ensuring that all players in the market are operating from the same playbook. Lastly, it fosters innovation by encouraging the development of new products and services tailored to specific geographic risks.

- Enhanced risk management capabilities

- Standardized approach to risk assessment

- Innovation in products and services

“PERILS EXTENDED will help close the protection gap by enabling insurers and reinsurers to better understand and cover risks in areas where data has traditionally been sparse,” noted Eva Davis, former Head of CRESTA. The merger will facilitate the expansion of insurance coverage in emerging markets, supporting economic resilience in these regions.

Looking ahead, the future prospects for the industry appear promising. With the combined strengths of PERILS and CRESTA, the industry can expect to see:

- Improved catastrophe risk modeling

- Increased insurance penetration in underserved areas

- Greater collaboration among industry players

- More effective response and recovery efforts following catastrophes

As the industry continues to evolve, PERILS EXTENDED is poised to play a pivotal role in shaping its future, ultimately benefiting societies and economies worldwide.

FAQ

What was the total amount of insurance losses from natural catastrophes in 2024?

Why was 2024 dubbed ‘the year of the floods’?

What were the top three non-US catastrophes in terms of insured losses?

- Valencia Floods, Spain ($3.9 billion)

- Central Europe Floods ($1.5 billion)

- Ex-Hurricane Debby Floods, Canada ($1.2 billion)